Family Floater Plan with OPD: A Smart & Powerful Guide for Indian Families

Healthcare costs in India are rising rapidly, and while many families have basic health insurance, they often overlook a critical component: Outpatient Department (OPD) expenses. Most standard policies only cover you when you are hospitalized for 24 hours or more. But what about the frequent doctor visits, viral fevers, dental checkups, and diagnostic tests? This is where a family floater plan with OPD becomes essential. It bridges the gap between major hospitalization coverage and your daily medical needs, ensuring your savings aren’t drained by routine healthcare costs.

What Is a Family Floater Plan with OPD?

A family floater plan with OPD is a comprehensive health insurance solution designed to cover the entire family under a single policy while offering benefits beyond just hospitalization. Traditional “floater” plans share a sum insured across all family members for surgeries or serious illnesses. However, when you add OPD benefits, the plan evolves.

It starts covering “out-of-pocket” expenses that usually aren’t reimbursed. This includes consultation fees for general physicians or specialists, pharmacy bills, and diagnostic investigations like blood tests or X-rays. By bundling these services, families get a holistic safety net that protects them from both major medical emergencies and minor, yet frequent, health issues.

Why OPD Benefits Matter More Than Ever

In the current economic climate, medical inflation is outpacing general inflation. A simple visit to a specialist in a metro city can cost anywhere from ₹500 to ₹1,500. When you multiply this by the number of family members and the frequency of seasonal illnesses, the annual cost becomes significant.

A family floater plan with OPD addresses these financial leaks directly.

- Doctor Visit Costs: Routine consultations for flu, infections, or follow-ups add up quickly.

- Diagnostic Test Expenses: Preventive health checkups and prescribed scans are expensive recurring costs.

- Prescription Medicines: Chronic conditions like diabetes or hypertension require monthly medication, which is rarely covered by standard indemnity plans.

- Rising Medical Inflation: With healthcare costs increasing yearly, paying for these services out of pocket is becoming unsustainable for middle-class households.

Benefits of Choosing a Family Floater Plan with OPD

Opting for a plan that includes OPD coverage offers immediate value because you don’t have to wait for a medical emergency to use it. You can utilize the benefits for everyday health needs.

- Cashless OPD: Access doctor consultations without paying cash upfront at network clinics.

- Teleconsultations: Get medical advice from the comfort of your home, saving travel time and exposure to infections.

- Diagnostics Discounts: Enjoy reduced rates on essential lab tests and scans.

- Pharmacy Savings: Get discounts on prescribed medicines, reducing the burden of monthly bills.

To see specifically how these benefits can apply to your family, check our detailed options on our Plans page.

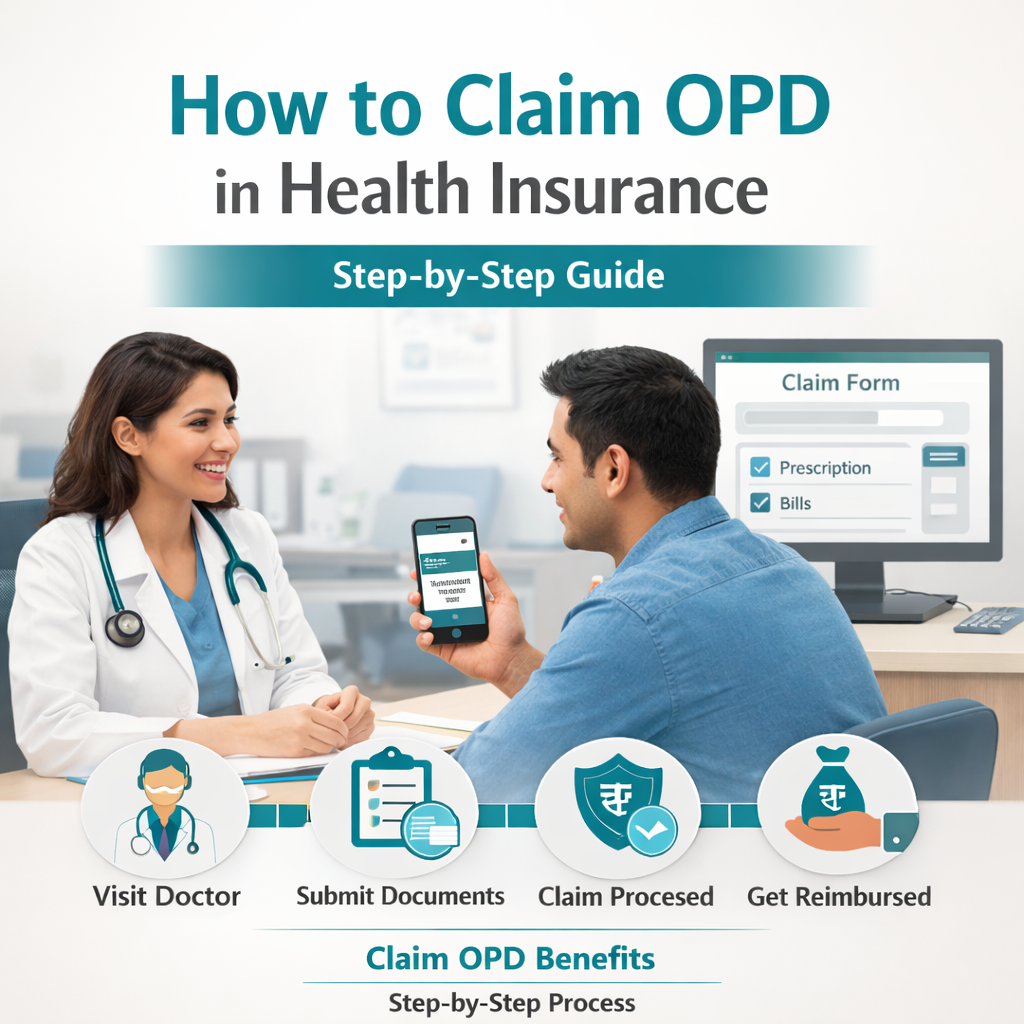

Understanding an OPD Plan

An opd plan is specifically designed to manage outpatient expenses that do not require hospital admission. Unlike standard health insurance which sits idle until a major event occurs, this plan is active immediately for day-to-day healthcare needs. It is essential for families with young children who need frequent pediatrician visits, or elderly parents requiring regular monitoring. Corporates also find immense value in these plans for employee wellness, ensuring their workforce stays healthy without financial stress. If you are a business looking to support your team, please visit our Contact page to learn more.

What Is OPD Medical Insurance?

Opd medical insurance serves as a financial shield against the recurring costs of outpatient care. It effectively creates a designated fund for non-hospitalization medical expenses. This type of insurance is particularly crucial because outpatient costs in India account for a massive portion of total healthcare spending—often more than hospitalization costs. By securing this coverage, you ensure that every fever, dental ache, or routine check-up is paid for by the insurer, rather than your personal savings.

What Is Health Insurance with OPD Coverage?

When we talk about health insurance with opd, we are referring to a hybrid model that combines the security of hospitalization cover with the utility of outpatient care. Standard policies are for “sick care” (treating you when you are critically ill), while insurance with OPD acts as “preventive care.” It encourages you to see a doctor early before a small symptom becomes a big problem. This proactive approach leads to better long-term health outcomes for the whole family. You can learn more about our philosophy on preventive care on our About Us page.

Why SwasthOPD Is India’s Best Choice for OPD Coverage

At SwasthOPD, we understand that healthcare needs to be accessible, affordable, and convenient. With over 12+ years of healthcare expertise, we have curated plans that address the real pain points of Indian families.

We are proud to offer:

- Cashless OPD benefits ensuring a hassle-free experience.

- Affordable plans that include discounts on diagnostics and pharmacy bills.

- Access to 600+ doctors and top-tier diagnostic centers across the nation.

- Trust and Reliability: We are trusted by 110+ corporates and serve over 28,000+ satisfied customers.

Whether you need individual health plans or comprehensive employee wellness solutions, our nationwide convenience ensures you are covered wherever you go. Visit SwasthOPD to join our growing family.

How Family Floater Plan with OPD Helps Reduce Monthly Medical Expenses

Integrating a family floater plan with OPD into your financial planning is a smart move. Instead of paying full price for every consultation or lab test, you pay a fixed, affordable premium. In return, you get access to discounted or cashless services throughout the year. This predictability helps in budgeting and ensures that a sudden wave of seasonal flu in the family doesn’t upset your monthly finances. It is important to stay informed about your rights and standard regulations regarding health insurance. You can review the guidelines set by the Insurance Regulatory and Development Authority of India (IRDAI) regarding health insurance standards at https://irdai.gov.in.

Conclusion: Why Every Household Should Consider a Family Floater Plan with OPD

In summary, reliance on basic hospitalization insurance is no longer enough. The financial impact of daily medical bills is real and growing. A family floater plan with OPD offers the comprehensive protection modern families need. It covers the “small” costs that eventually become large burdens, ensures timely medical attention, and protects your hard-earned savings.

Don’t wait for an emergency to prioritize your health coverage.

Explore affordable OPD plans at https://swasthopd.in/plans