When most people think about health insurance, they imagine protection against major medical emergencies—surgeries, accidents, or long hospital stays. While these are critical, they aren’t the most frequent medical expenses we face. Think about the last time you visited a doctor. Was it for a surgery, or was it for a seasonal flu, a dental check-up, or perhaps a routine blood test What is OPD cover in health insurance?

For the majority of us, healthcare is a series of small, recurring costs rather than one major event. These costs, often referred to as out-of-pocket expenses, can silently drain your savings over time. This is where the concept of Outpatient Department (OPD) coverage becomes a game-changer. But many policyholders are still asking: What is OPD cover in health insurance?

Understanding this feature is the key to closing the gap in your financial protection. By covering the medical visits that don’t require a hospital bed, OPD coverage ensures that your day-to-day health needs are met without financial stress.

What is OPD cover in health insurance?

To put it simply, what is OPD cover in health insurance? It is a specific component of a health insurance policy designed to cover medical costs for treatments that do not require hospitalization for more than 24 hours.

In traditional health insurance plans, a claim is usually only valid if the patient is admitted to the hospital. However, medical science has advanced, and our lifestyles have changed. Many treatments that once kept patients in wards for days are now completed in a few hours. Furthermore, general consultations for viral fevers, minor injuries, or specialist opinions happen entirely outside the hospital room.

OPD cover steps in to pay for these “walk-in, walk-out” expenses. In our busy modern lifestyles, where people frequently require quick non-hospitalized treatments or regular health monitoring, having this coverage is becoming less of a luxury and more of a necessity. It ensures that you don’t hesitate to see a doctor due to the cost of consultation fees.

If you are looking for plans that specifically cater to these needs, you can explore various comprehensive health plans that prioritize everyday wellness alongside emergency protection.

OPD Coverage in Health Insurance Plans

Not all policies are created equal, and understanding how OPD fits into your plan is crucial. While some modern comprehensive policies include OPD benefits as a standard feature, others offer it as an add-on rider that you must purchase separately.

The scope of coverage varies significantly. A basic plan might only cover general physician consultations up to a certain limit. In contrast, a premium plan could cover specialist fees, pharmacy bills, and even alternative treatments like Ayurveda or Homeopathy. As the demand for holistic healthcare rises, insurers are increasingly embedding these benefits into their core offerings.

It is important to read the fine print regarding waiting periods and sub-limits. Some plans allow you to claim OPD expenses from day one, while others may ask you to wait. To understand the different structures of these policies, you can read more about the benefits of OPD health insurance.

For a broader understanding of how outpatient services are defined globally and their importance in public health, you can refer to the World Health Organization (WHO) resources on primary health care.

OPD Expenses Covered Under Health Insurance

When you ask, “What is OPD cover in health insurance?“, you are essentially asking what specific bills will be paid. The list is often more extensive than people realize.

Here is a breakdown of common expenses that fall under this category:

- Doctor Consultation Fees: The cost of visiting a General Physician or a Specialist for advice.

- Diagnostic Tests: This includes pathology lab tests (blood, urine) and radiology services like X-rays, MRIs, and CT scans.

- Pharmacy bills: Prescribed medicines related to the ailment treated during the OPD visit.

- Minor Procedures: Treatments like dressing wounds, casts for fractures, or minor dental procedures.

- Preventive Care: Vaccinations and annual health check-ups.

Without insurance, these costs are typically paid out-of-pocket. A single MRI scan or a course of antibiotics might not break the bank, but over a year, these costs accumulate significantly. With the right policy, these financial leaks are plugged. For specific details on how diagnostics are handled, check out this guide on diagnostic tests insurance cover.

Health Insurance with OPD Benefits: Why You Need It

Choosing a policy with OPD benefits is a strategic move for total health management. It encourages a proactive approach to healthcare. When you know that your consultation fee is covered, you are more likely to visit a doctor at the first sign of illness rather than self-medicating or ignoring symptoms until they worsen.

This is particularly vital for individuals managing chronic conditions like diabetes, hypertension, or thyroid issues. These conditions require regular monitoring, frequent doctor visits, and consistent medication—all of which are classic OPD expenses. A policy that covers these costs helps you manage your condition effectively without worrying about the monthly financial burden.

Furthermore, for families with young children or elderly parents, the frequency of hospital visits is naturally higher. Plans that offer cashless OPD services can provide immense relief. You can learn more about selecting the right coverage for your household in our article on how to choose the best OPD plan for your family.

Best Health Insurance for OPD Coverage

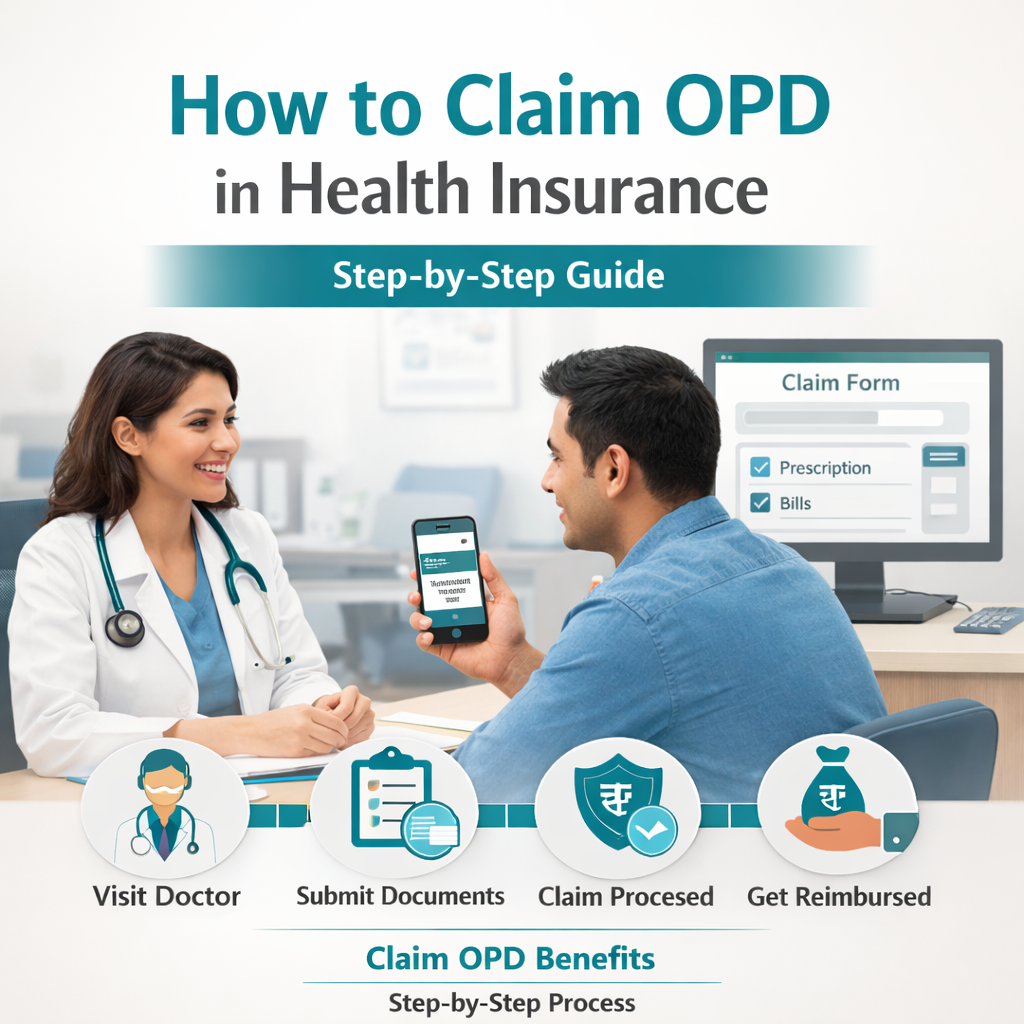

Finding the best health insurance requires looking beyond the premium cost. If you are specifically seeking an answer to “What is OPD cover in health insurance?” regarding quality, you need to evaluate the value the plan delivers.

Here are criteria to consider when selecting the best plan:

- Network Strength: Does the insurer have a wide network of clinics and diagnostic centers near you? Cashless OPD is only useful if you can access it easily.

- Coverage Limits: Check the maximum amount you can claim for OPD in a year. Ensure it matches your typical annual medical spend.

- Claim Process: Is the process digital and paperless? Modern “Health Tech” platforms often allow you to book appointments and settle claims via an app, which is far superior to saving physical receipts for reimbursement.

- Inclusions: Does it cover dental? Does it cover existing illnesses?

Comparing policies is essential. Look for insurers who are transparent about their sub-limits and offer flexibility.

Conclusion

Healthcare is evolving, and your insurance should evolve with it. The question isn’t just “What is OPD cover in health insurance?“, but rather, can you afford to be without it?

OPD coverage bridges the gap between staying healthy and staying solvent. It ensures that your access to quality healthcare isn’t limited to emergencies but extends to your everyday well-being. By taking care of the small bills, it allows you to focus on what truly matters: your health.

Assess your medical needs today. If you find yourself visiting the doctor frequently, it is time to switch to a plan that supports your lifestyle.

Ready to upgrade your health protection? Visit SwasthOPD today to explore tailored health plans that offer comprehensive OPD coverage designed for you and your family.