Imagine this scenario: You wake up with a persistent headache or a mild fever that just won’t go away. You know you should see a doctor, but you hesitate. You think about the consultation fee, the likely prescription costs, and the dread that the doctor might order expensive blood tests. “It’s probably nothing,” you tell yourself, popping a painkiller from the local chemist instead insurance for consultations and tests.

This is the reality for millions of Indian families. We often treat healthcare as an emergency service—something we only use when we are rushing to the hospital. Standard health insurance policies (Mediclaim) usually kick in only when there is hospitalization for 24 hours or more. They completely ignore the day-to-day medical expenses that drain our wallets.

However, ignoring small symptoms often leads to bigger, more expensive problems down the road. This is where Insurance for consultations and tests becomes a vital tool for your financial and physical health. It covers the gap that traditional insurance leaves wide open. By taking care of these smaller, routine costs, services like SwasthOPD ensure that you never have to hesitate before seeking medical advice.

OPD Insurance for Doctor Consultation

When we talk about Outpatient Department (OPD) coverage, we are referring to medical visits that do not require you to be admitted to a hospital bed. This includes visiting a General Physician for a viral fever, consulting a specialist for a recurring backache, or seeing a pediatrician for your child’s vaccination.

OPD insurance for doctor consultation is a game-changer because it encourages you to seek help early. In India, a significant portion of healthcare expenditure comes directly out of our pockets. A single visit to a specialist in a metro city can cost anywhere between ₹800 to ₹1500. If you have elderly parents or young children at home, these visits happen frequently, and the costs accumulate rapidly.

When you have a plan that covers these consultations, the financial barrier is removed. You are more likely to visit the doctor at the first sign of trouble rather than waiting for the condition to worsen. This is the essence of preventive healthcare. Platforms like SwasthOPD facilitate these visits by offering cashless or reimbursed options, ensuring that your focus remains on recovery rather than the bill.

If you are looking for a way to manage these recurring costs effectively, exploring comprehensive health plans is the first step toward securing your family’s everyday health.

Health Insurance Covering OPD Tests

Doctor visits are rarely just about the conversation; they are often followed by diagnostics. Whether it is a routine blood sugar profile for a diabetic patient, a thyroid function test, or an X-ray for a sprained ankle, diagnostic tests provide the roadmap for correct treatment.

Unfortunately, diagnostics are expensive. Many people skip prescribed tests because they feel fine in the moment, only to discover later that an underlying issue has progressed. Health insurance covering OPD tests ensures that you can follow your doctor’s advice without worrying about the price tag. When your policy covers diagnostics, you are empowered to get that MRI or that lipid profile done immediately.

Early detection is the most powerful tool in medicine. Detecting high cholesterol early can prevent heart disease. Catching a vitamin deficiency can solve chronic fatigue. By investing in Insurance for consultations and tests, you are essentially investing in early detection. This proactive approach drastically reduces the chances of needing emergency hospitalization in the future, which saves you from significantly higher emotional and financial stress.

You can learn more about how we structure our services to prioritize your long-term well-being on our About Us page.

Insurance for OPD Consultation and Diagnostics

Healthcare is a loop. It starts with a symptom, moves to a consultation, leads to diagnostics, and results in treatment or medication. If any part of this loop is broken due to lack of funds, your health suffers.

Insurance for OPD consultation and diagnostics binds this loop together. It provides a safety net for the entire process of outpatient care. Think of it as a shield for your savings. Instead of dipping into your emergency funds every time someone falls sick, a dedicated OPD plan handles the expense.

For professionals and business owners, this is also about time and convenience. Managing receipts and worrying about the cost of every individual test adds unnecessary mental load. A comprehensive plan streamlines the process. It allows you to walk into a clinic or a diagnostic center with confidence.

SwasthOPD acts as a facilitator in this journey. We are not just selling a product; we are helping you build a habit of health. By ensuring that both the doctor’s advice and the necessary proofs (tests) are covered, we help you complete the healthcare loop. Prioritizing insurance for consultations and tests means you are prioritizing a lifestyle where health is not a luxury, but a guaranteed standard of living.

For those interested in how these benefits apply to corporate teams, check out our insights on employee wellness.

Affordable OPD Insurance for Tests

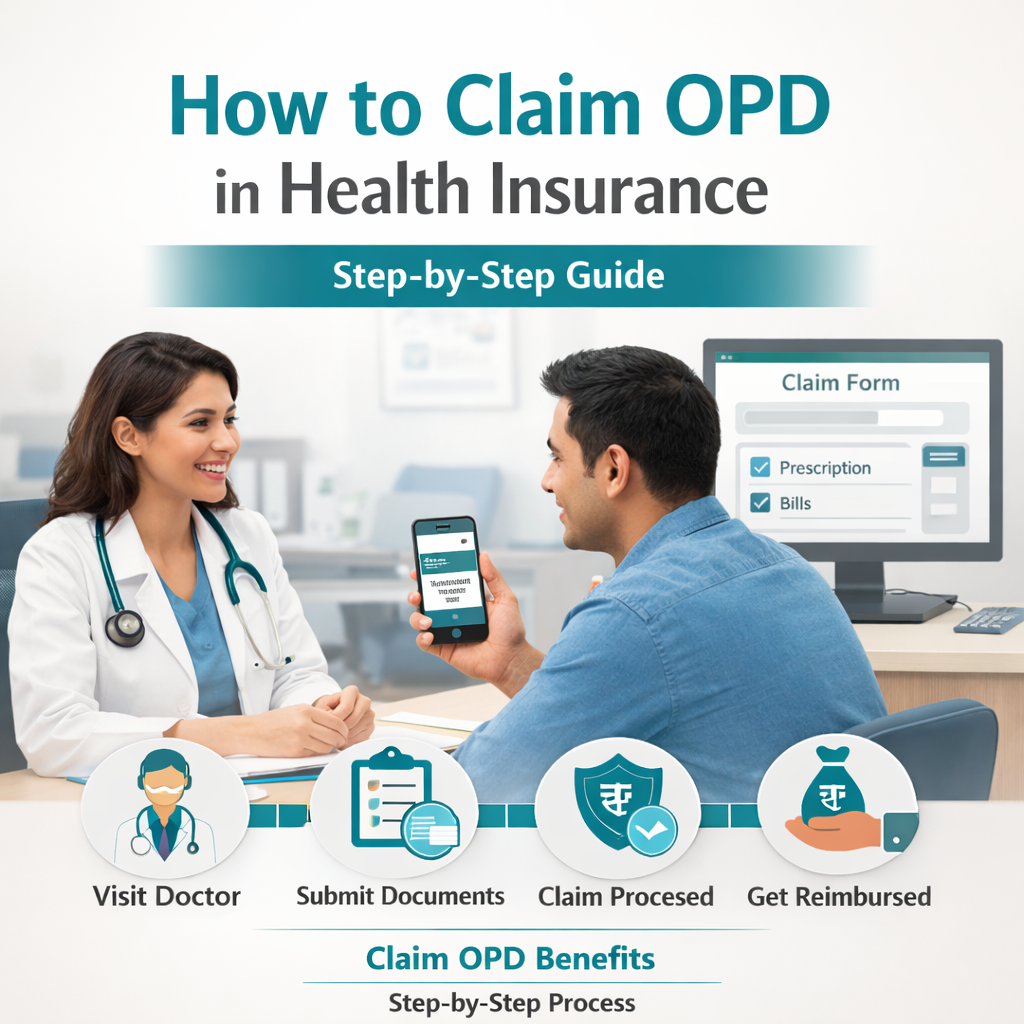

There is a common misconception that comprehensive health coverage is too expensive for the average middle-class family. However, when you do the math, the opposite is true. Calculate how much you spend annually on doctor fees, pharmacy bills, and lab tests for your entire family. The number is often much higher than you realize.

Affordable OPD insurance for tests is designed to cost less than these out-of-pocket expenses. By paying a small subscription or premium, you unlock coverage that far exceeds the cost of individual visits. For example, a single MRI scan can cost as much as an entire year’s OPD plan premium in some cases.

Affordability is crucial in the Indian context. We believe that quality healthcare shouldn’t drain your bank account. Whether you are a young professional just starting out or a head of a family managing a household budget, having an OPD plan makes financial sense. It converts unpredictable medical spikes into a predictable, manageable yearly cost.

Furthermore, many of these plans come with value-added services like teleconsultations, which save you travel time and money. When you look for insurance for consultations and tests, always compare the coverage against your typical yearly spending. You will likely find that an OPD plan is the most economical choice you can make.

According to the World Health Organization (WHO), minimizing out-of-pocket payments is essential for protecting people from financial hardship and ensuring universal health coverage. OPD insurance is a direct step toward this global goal.

Conclusion

The landscape of healthcare in India is changing. We are moving away from a mindset of “sickness management” toward “wellness management.” Relying solely on hospitalization insurance is like waiting for a car to break down before checking the engine oil. It is risky and expensive.

Insurance for consultations and tests is the bridge to better health. It covers the small steps that prevent the big falls. It ensures that a fever is treated before it becomes an infection, and a pain is diagnosed before it becomes a chronic condition. By covering the costs of doctors and diagnostics, you are removing the hesitation that stands between you and good health.

Choosing the right OPD-focused plan today can prevent bigger health and financial problems tomorrow. If you are ready to take control of your day-to-day medical needs, we are here to help you navigate your options.

Contact us today to discuss a plan that fits your life and your budget.