You likely have health insurance to protect yourself against major medical emergencies. It is a safety net we all hope we never have to use, but are grateful for when a crisis strikes. But what about the day-to-day medical expenses that slowly drain your savings?

From seasonal fevers and dental checkups to routine blood tests and pharmacy bills, these costs add up significantly over a year. Yet, standard health insurance policies rarely cover them because they don’t require hospitalization.

This is where OPD cover insurance steps in.

If you are looking for comprehensive coverage that ensures access to quality healthcare without breaking the bank, SwasthOPD provides personalized OPD insurance plans designed to give you the peace of mind you deserve. In this guide, we’ll explore how affordable OPD cover insurance can benefit you and your family, highlighting the best plans, cashless coverage, and why SwasthOPD is the right choice for your healthcare needs.

What is OPD Cover Insurance?

To understand the value of this coverage, you must first distinguish between IPD (Inpatient Department) and OPD (Outpatient Department). Traditional health insurance is primarily IPD-focused, meaning it kicks in only when you are admitted to a hospital for 24 hours or more.

OPD cover insurance, on the other hand, is designed to provide financial protection for medical expenses that do not require hospitalization. This includes the vast majority of your interactions with the healthcare system.

When you visit a general physician for a viral infection, get an X-ray for a sprained ankle, or pick up prescription medication, you are utilizing outpatient services. Without specific insurance, these are all out-of-pocket expenses.

SwasthOPD offers tailored OPD cover insurance plans that ensure timely and affordable access to these essential services. With SwasthOPD, you can avoid the financial sting of routine care by availing cashless consultations, diagnostic tests, and more.

[Visit SwasthOPD Plans] for more details on how to bridge this gap in your healthcare portfolio.

Affordable OPD Cover Insurance: A Smart Healthcare Investment

There is a common misconception that adding OPD cover to your insurance portfolio is an unnecessary luxury. However, when you calculate your annual spend on doctors, dentists, optometrists, and pharmacies, the math tells a different story.

Finding affordable OPD cover insurance that doesn’t compromise on quality can be challenging, but it is a financial necessity for modern living. SwasthOPD makes it easy by offering cost-effective plans tailored to meet your specific healthcare needs.

Why Prioritize Affordability and Prevention?

The true value of an affordable plan lies in preventive care. When people have to pay for every doctor’s visit from their own pockets, they often delay seeking medical advice until a minor issue becomes a major health crisis. With insurance in place, you are more likely to schedule that checkup early.

Whether you’re looking to cover basic consultations or preventive checkups, our affordable OPD insurance options provide a comprehensive range of services. With SwasthOPD, you can rest assured that you’re investing in a health plan that balances affordability and quality.

Best OPD Insurance Plans: Tailored for You and Your Family

Healthcare is personal. A young professional has different medical needs than a senior citizen or a family with toddlers. Therefore, the best OPD insurance plans are those that offer flexibility and customization.

SwasthOPD leads the way in providing adaptable solutions. Our plans are designed with families in mind, ensuring that everyone from children to adults can access the healthcare they need without worrying about escalating costs.

What should the best plans include?

- General Physician Consultations: Access to a broad network of doctors for everyday ailments.

- Specialist Consultations: Coverage for dermatologists, cardiologists, and other specialists.

- Pharmacy Expenses: Coverage for prescribed medicines.

- Diagnostic Tests: Pathology and radiology services (blood tests, MRIs, CT scans).

Our OPD cover insurance plans include all these essentials, alongside regular consultations and mental health services. Whether you’re an individual or part of a family, you can find the best OPD insurance plan that suits your needs at [Best OPD Insurance Plans].

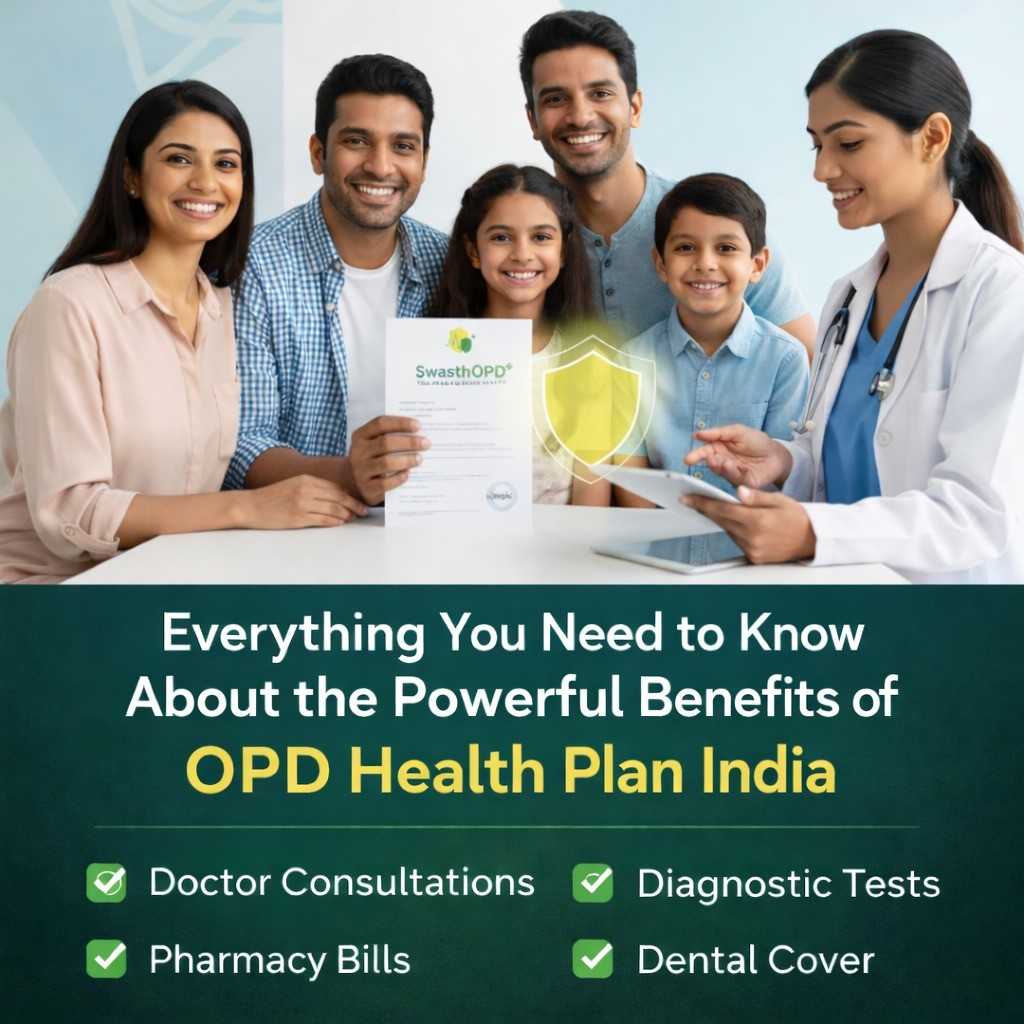

OPD Insurance Benefits for Families: A Complete Healthcare Solution

Managing the health of a single individual is manageable, but managing the health of a family can be financially unpredictable. Children are prone to infections and injuries that require frequent pediatrician visits. Adults require routine screenings for blood pressure, cholesterol, and diabetes.

For families, having OPD insurance benefits ensures that everyone has access to quality healthcare without the stress of high medical bills. SwasthOPD offers specialized family health plans, providing coverage for consultations, tests, and routine checkups.

The Peace of Mind Factor

By opting for OPD cover insurance, you ensure that your loved ones are always covered for common illnesses and health concerns. You never have to choose between your budget and your family’s health.

Our family plans also offer extra features such as mental health support and fitness programs, promoting a holistic approach to well-being. To explore family-friendly insurance options, visit [Family Health Plans].

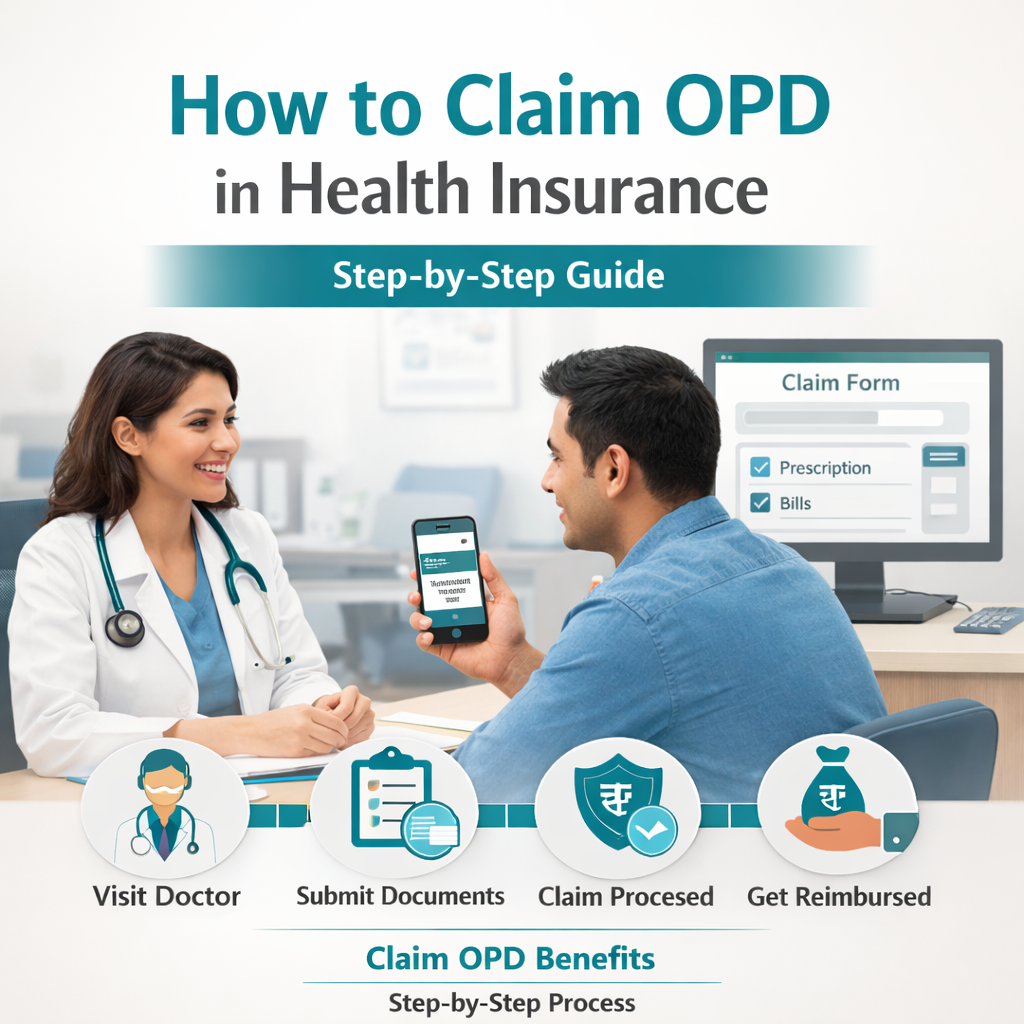

Cashless OPD Insurance Coverage: Simplifying Healthcare Access

One of the biggest friction points in traditional insurance is the reimbursement process—collecting bills, filling out forms, and waiting for weeks to get your money back.

Cashless OPD insurance coverage offers a hassle-free experience when it comes to paying for medical services. With SwasthOPD, the process is streamlined. You can access a network of top doctors and diagnostic centers without having to worry about upfront payments.

How Cashless Coverage Works

- Locate a Network Provider: Use the SwasthOPD app or website to find a doctor or lab near you.

- Book an Appointment: Schedule your visit through the platform.

- Visit and Treat: Show your digital health card.

- Walk Out: The bill is settled directly between the provider and the insurer.

Our OPD cover insurance plans offer cashless benefits for a variety of outpatient services, including consultations, tests, and follow-ups. This ensures that you can focus on your health without the stress of medical bills. Find out more about cashless coverage at [Cashless OPD Coverage].

Frequently Asked Questions

Is dental treatment covered under OPD insurance?

Most standard health insurance plans exclude dental procedures unless they require hospitalization due to an accident. However, many comprehensive OPD insurance plans do include coverage for dental consultations, root canals, and extractions up to a specified limit.

Can I claim tax benefits on OPD insurance?

In many jurisdictions, premiums paid toward health insurance, including OPD riders or standalone OPD policies, are eligible for tax deductions. It is best to consult with a tax advisor regarding the specific laws in your region (such as Section 80D in India).

Does OPD cover include pre-existing diseases?

Coverage for pre-existing diseases varies by plan. While some plans cover them immediately, others may have a waiting period. It is crucial to read the policy wording carefully before purchasing.

Securing Your Health and Wallet with SwasthOPD

Choosing the right OPD cover insurance is essential to securing your health and well-being. It closes the gap left by traditional hospitalization insurance, ensuring you are protected against the high frequency of outpatient costs.

Whether you are looking for affordable OPD insurance, searching for the best OPD insurance plans on the market, or securing comprehensive OPD insurance benefits for families, SwasthOPD has a solution for you. With our cashless OPD insurance coverage, you can access top-quality healthcare whenever you need it, removing financial barriers to medical advice.

Visit [SwasthOPD] today to explore the plans that best fit your needs!