What Are the Benefits of OPD Health Insurance? A Complete Guide for Indian Families

Have you ever looked at your monthly budget and realized just how much money slips away on “small” medical expenses? A fever here, a dental check-up there, or perhaps a routine blood test for your parents. In India, these costs are often paid directly from our pockets, and they add up incredibly fast. While most of us have standard health insurance for hospitalization, we often ignore the day-to-day medical costs that drain our savings silently.

This is where Out-Patient Department (OPD) coverage steps in. But many people still wonder, what are the benefits of OPD health insurance? Is it really worth the extra investment? The answer lies in understanding how healthcare consumption is changing in India. We visit doctors far more often for consultations and minor treatments than we get admitted to hospitals. By covering these frequent visits, OPD insurance acts as a shield for your daily finances.

In this guide, we will break down everything you need to know—from how billing works to the specific advantages of having a plan that covers your regular doctor visits.

What Is OPD Health Insurance?

Before we dive into what are the benefits of OPD health insurance?, let’s clarify what this insurance actually is. Traditional health insurance usually kicks in only when you are hospitalized for at least 24 hours. OPD health insurance, however, covers medical expenses that do not require hospitalization.

Think about the last time you visited a doctor. You likely went to the clinic, got a consultation, maybe bought some medicines at the pharmacy, or got an X-ray done, and then went home. This entire cycle is “Out-Patient” care.

OPD health insurance is designed to cover these exact costs. It takes care of general physician fees, specialist consultations, diagnostic tests like blood work or MRIs, and pharmacy bills. For an Indian family managing tight budgets, this means that a sudden seasonal flu or a recurring thyroid check-up doesn’t have to disrupt your monthly financial planning. And when you understand what are the benefits of OPD health insurance?, it becomes clear how essential this coverage is for managing everyday medical expenses smoothly.

What Are the Benefits of OPD Health Insurance?

When you ask what are the benefits of OPD health insurance, the answer goes far beyond just saving a few rupees on a doctor’s fee. It is about comprehensive healthcare management. Let’s explore the key advantages that make these plans essential for modern living.

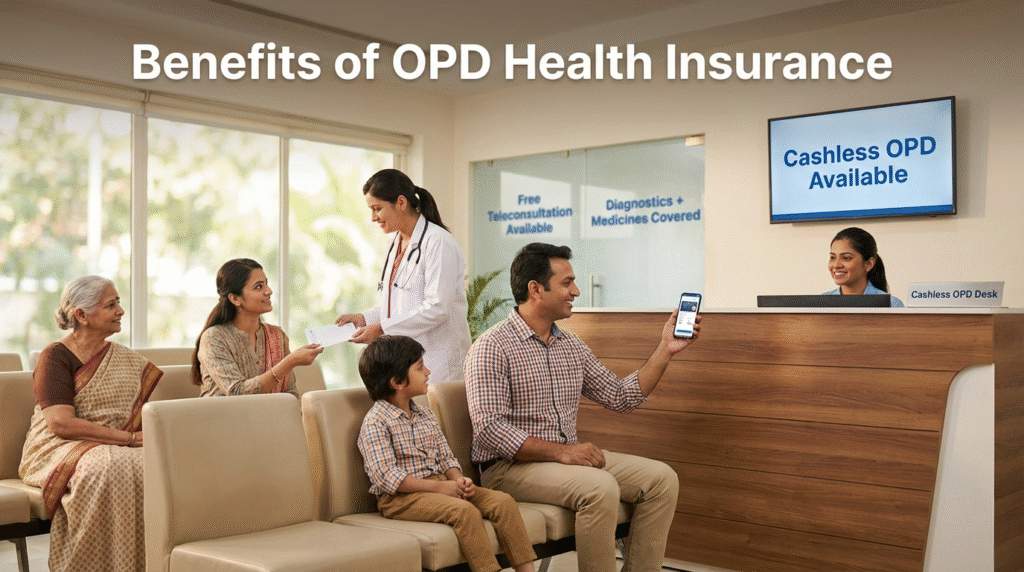

1. Cashless OPD Services

One of the biggest headaches in Indian healthcare is the need to carry cash or worry about reimbursement claims later. With modern OPD plan benefits, you get access to cashless services. This means you can walk into a network clinic or diagnostic center, show your digital health card, and get treated without paying upfront. You don’t have to collect bills, fill out tedious forms, and wait weeks for the money to hit your bank account. It simplifies the entire experience.

2. Unlimited Teleconsultation

In today’s digital age, dragging yourself to a clinic for a minor issue isn’t always necessary. Many OPD plans now offer unlimited teleconsultations. Whether it’s a skin rash, a mild stomach ache, or a follow-up on a previous visit, you can speak to a qualified doctor via video or audio call from the comfort of your home. This saves travel time and reduces the risk of catching infections in crowded waiting rooms.

3. Substantial Savings on Diagnostics

Diagnostic tests are often more expensive than the doctor’s consultation fee itself. A full-body check-up or specific hormone tests can cost thousands of rupees. When considering what are the benefits of OPD health insurance, the discounts on lab tests are a major highlight. OPD plans often provide significant coverage or heavy discounts on pathology and radiology services, ensuring you don’t skip essential tests due to high costs.

4. Pharmacy Benefits

Medicine costs are a recurring burden, especially for families with senior citizens dealing with diabetes, hypertension, or heart conditions. Unlike standard mediclaim policies that ignore pharmacy bills, OPD insurance often covers the cost of prescribed medicines. This benefit alone can help families recover the cost of the premium within a few months of usage.

5. Access to Specialists

General physicians are great, but sometimes you need a specialist—a cardiologist, a dermatologist, or a pediatrician. Specialist fees in metro cities in India have skyrocketed. OPD coverage ensures that you can access these high-quality specialists without hesitation. You won’t have to compromise on the quality of advice just because the consultation fee is high.

6. Convenience and Time-Saving

Healthcare in India can be chaotic. Having an OPD plan often gives you priority access or streamlined appointment booking processes. Instead of waiting in long queues or struggling to find a good doctor, your insurance provider’s network connects you to verified professionals quickly. This convenience is invaluable when you or a loved one is unwell.

7. Preventive Health Check-ups

Prevention is better than cure, but it is also something we often delay because of the cost. Many OPD plans include free or discounted preventive health check-ups. This encourages you to monitor your health regularly. Catching a potential issue like high cholesterol or blood sugar early can save you from severe health crises—and massive hospital bills—down the road.

8. Financial Safety Net for the Whole Family

If you calculate the annual spend on OPD for a family of four, the number is often shocking. By paying a small, fixed premium for an OPD plan, you protect your savings from these unpredictable outflows. It brings predictability to your healthcare expenses, allowing you to save for other life goals.

OPD Billing: Making Sense of the Costs

If you have ever stood at a hospital counter, you know that opd billing can be a confusing and frustrating experience. In a traditional setup, the billing process is fragmented. You pay a registration fee at one counter, move to the doctor’s cabin, come back to pay for the consultation, go to the lab to pay for tests, and then visit the pharmacy to pay for medicines. This multiple-payment system is not only tiring but makes it hard to track how much you are actually spending.

Furthermore, billing transparency is often an issue. Prices for the same procedure can vary wildly between patients depending on who is paying—cash or insurance.

This is where services like ours transform the experience. With cashless OPD, the billing is consolidated and transparent. When you use Swasth OPD Plans, the complex billing layers are stripped away. You know exactly what is covered, and the transaction happens directly between the provider and the network partner. There are no hidden charges or surprise additions to the bill. By streamlining opd billing, we ensure that patients focus on recovery rather than calculating costs at every step.

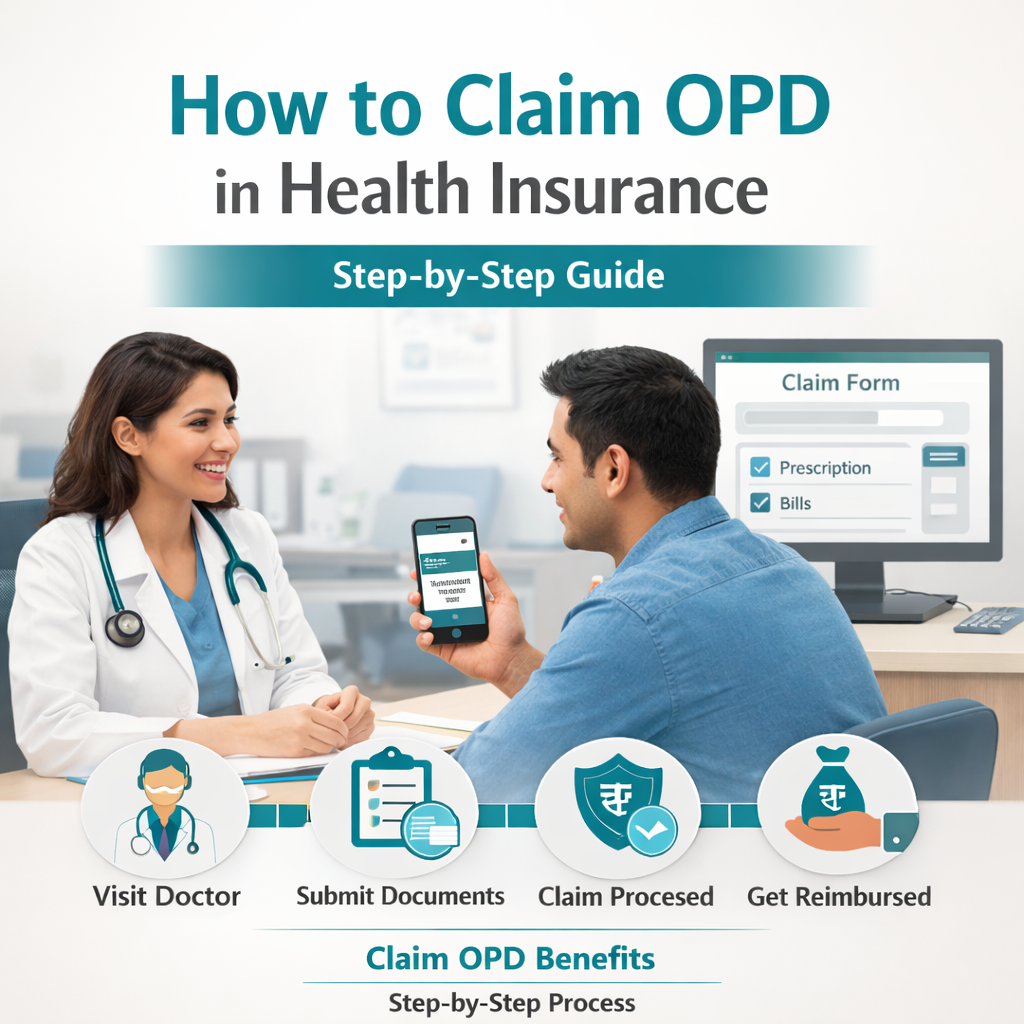

OPD Procedure: A Step-by-Step Comparison

Understanding the opd procedure helps in appreciating why insurance coverage is so vital. In a typical government or private hospital in India, the procedure follows a rigid, often exhausting path.

First, you arrive early to secure a spot in the queue. You undergo “Registration,” where your basic details are logged, and a file is created. Next is the “Waiting Period,” which can last from minutes to hours depending on the doctor’s load. Once you see the doctor, they may prescribe diagnostics. This disrupts the flow, as you must leave the consultation, go to the lab, get the test done (which is another opd procedure in itself), and then return with reports. Finally, you head to the pharmacy.

Without insurance, every step of this procedure requires a dip into your wallet. You are managing logistics and payments simultaneously.

However, with a dedicated OPD plan, the opd procedure becomes smoother. If you have a cashless plan, you skip the payment queues. You register, see the doctor, and get your tests done authorized immediately. You can learn more about cashless OPD benefits to see how this streamlined workflow reduces stress. The focus shifts from “how do I pay for this next step?” to “what does the doctor say?” which is how healthcare should be.

OPD Schedule PGI: The Challenge of Appointments

When discussing healthcare access in India, we must talk about scheduling. Let’s look at the concept of an opd schedule pgi as a reference point. PGI refers to premier institutes like the Post Graduate Institute of Medical Education & Research (PGIMER). These are top-tier government facilities where thousands of patients flock daily.

The opd schedule pgi is notorious for being packed. Patients often have to book appointments weeks or even months in advance. For a regular family needing immediate attention for a viral fever or a sudden back pain, adhering to such a rigid and overcrowded schedule is impossible. You simply cannot wait that long for primary care.

This highlights the gap that private OPD insurance fills. While institutes like PGI offer world-class care, the accessibility is limited by the sheer volume of patients. Private OPD plans give you access to a vast network of private clinics and hospitals where the schedule is flexible. You get the high-quality care you need without the agonizing wait times associated with a public opd schedule pgi. You can book appointments that fit your life, ensuring that medical attention is received exactly when it is needed, not weeks later.

Why OPD Health Insurance Is Becoming Essential in India

The healthcare landscape in India is shifting rapidly. It is no longer just about preparing for major surgeries; it is about managing overall well-being. Understanding what are the benefits of OPD health insurance is crucial as we face new health challenges.

1. Rising Healthcare Inflation

Medical inflation in India is consistently double-digit, often higher than general inflation. The cost of a simple consultation has doubled in many cities over the last five years. Without OPD coverage, these costs eat directly into disposable income.

2. Chronic Disease Management

India is becoming the diabetes and heart disease capital of the world. These are chronic conditions that require lifelong management—regular check-ups, daily medicines, and periodic lab tests. These are not one-time hospital events; they are monthly OPD expenses. OPD insurance is the only way to sustainably manage these costs.

3. Pediatric and Senior Citizen Care

Families with young children or elderly parents are the heavy users of OPD services. Kids need frequent vaccinations and pediatric visits. Seniors need constant monitoring. Affordable OPD packages act as a buffer, ensuring that financial constraints never force a compromise on their health.

4. Corporate Wellness Focus

Even companies are realizing that healthy employees are productive employees. Many corporates are now looking beyond standard mediclaim and seeking plans that cover daily health needs, recognizing that preventive OPD care reduces sick leaves in the long run.

Swasth OPD: The Most Affordable OPD Solution in India

At Swasth OPD, we are committed to revolutionizing how India accesses healthcare. We understand that health expenses don’t start at the hospital door—they start at the first sign of illness.

We have built a robust network to serve you better:

- 600+ Doctors across various specialities.

- 220+ Centers ensuring care is always nearby.

- 110+ Corporates trust us with their employee health.

- 28,000+ Customers are currently saving on their medical bills with us.

Whether you are looking for affordable OPD packages for your parents or a comprehensive plan for your employees, we have a solution tailored for you. Our goal is to make high-quality healthcare accessible and cashless for every Indian.

If you have questions about how to choose the right plan for your family, you can contact Swasth OPD team today. We are here to guide you through the options and help you start saving.

Comparison: OPD Insurance vs. Traditional Health Insurance

To make the right choice, it helps to see the differences side-by-side. Here is how modern OPD plans stack up against traditional health insurance.

| Feature | Traditional Health Insurance (Mediclaim) | OPD Health Insurance |

|---|---|---|

| Primary Coverage | Hospitalization (In-patient care) | Doctor visits, diagnostics, pharmacy (Out-patient care) |

| Frequency of Use | Rare (Only during emergencies/surgeries) | Frequent (Routine illnesses, check-ups) |

| Condition for Claim | Usually requires 24-hour admission | No admission required |

| Medicine Costs | Generally not covered post-discharge | Covers prescribed pharmacy bills |

| Preventive Care | Limited or absent | High focus on preventive check-ups |

| Billing Type | Reimbursement or Cashless | Cashless OPD benefits are common |

| Cost Impact | Protects against large, one-time shocks | Protects against monthly recurring expenses |

Global Context on Out-Patient Care

The shift toward outpatient care is not just happening in India; it is a global trend. Healthcare systems worldwide are prioritizing preventive and primary care to reduce the burden on hospitals. For more global context, you can refer to the global health guidelines by WHO, which emphasize the importance of accessible primary health care as the foundation of a healthy society.

Conclusion

Healthcare expenses are an inevitable part of life, but they don’t have to be a financial burden. The rising costs of consultations and medicines make it clear that relying solely on hospitalization insurance is no longer enough.

The answer to what are the benefits of OPD health insurance is clear: it offers financial protection, immediate access to quality care, and the peace of mind that comes from knowing your day-to-day health needs are covered. It encourages you to visit the doctor when you first feel sick, rather than waiting until it becomes an emergency.

For families, for seniors, and for anyone who values their health and hard-earned money, an OPD plan is an essential tool.

Now that you understand what are the benefits of OPD health insurance, choosing the right OPD plan becomes easier. Don’t let minor medical bills drain your savings anymore.

👉 Check out our Swasth OPD Plans and secure your family’s daily health today!