Introduction

For decades, the standard for employee benefits was simple: provide basic hospitalization coverage and call it a day. But the modern workforce is different. Employees are no longer satisfied with a policy that only kicks in during a catastrophe. They are looking for support in their daily lives—support that addresses the nagging cough, the routine dental check-up, the prescription glasses, and the preventative blood work. This is where corporate Outpatient Department (OPD) health insurance steps in to fill the gap.

Corporate OPD health insurance is quickly becoming a non-negotiable asset for businesses that want to build a resilient, loyal, and healthy workforce. It signals to your team that you care about their well-being before they end up in a hospital bed. With healthcare inflation outpacing salary growth in many sectors, the financial burden of routine medical costs falls heavily on employees. A plan that covers these expenses mitigates financial stress and encourages staff to seek medical attention early, rather than waiting until a minor issue becomes a major health crisis.

SwasthOPD’s tailor-made corporate OPD health insurance solutions are designed to bridge this gap. By offering accessible, affordable, and comprehensive healthcare benefits, organizations can transform their benefits package from a standard offering into a competitive advantage. This guide explores why OPD coverage is the future of employee benefits and how you can implement it effectively.

Employee OPD Coverage Plans: The First Line of Defense

When we talk about traditional health insurance, we usually refer to Inpatient Department (IPD) care—coverage that applies only when a patient is admitted to a hospital for 24 hours or more. While critical for emergencies, IPD coverage ignores the reality of how most people interact with the healthcare system. Most medical interactions happen in the Outpatient Department (OPD).

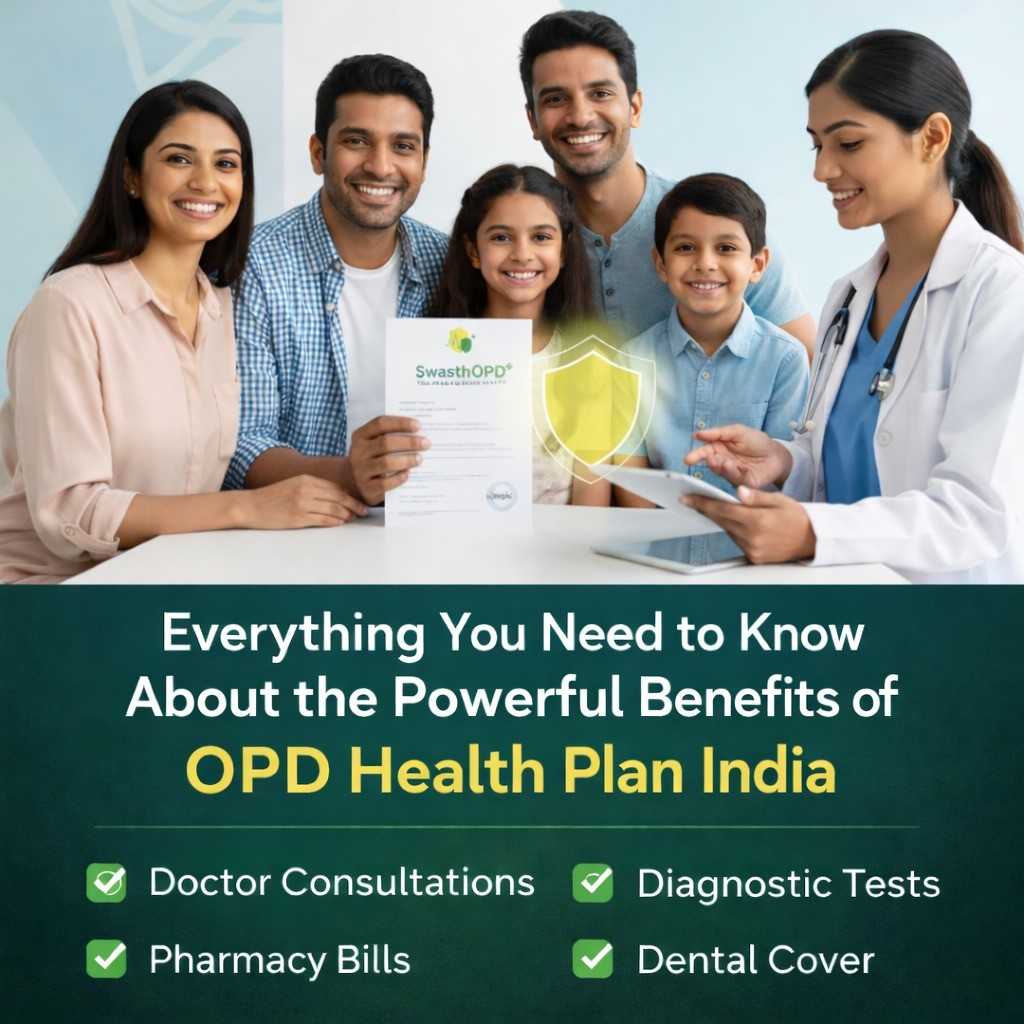

Employee OPD Coverage Plans are integral to a holistic corporate health insurance strategy because they cover the day-to-day medical needs of your workforce. This includes doctor consultations, general physician visits, prescribed diagnostics (like blood tests or X-rays), and pharmacy bills. Without OPD coverage, these costs come directly out of the employee’s pocket. Over a year, these “small” expenses accumulate, often leading employees to delay necessary care to save money.

The Value of Preventive Care

The true power of OPD coverage lies in prevention. When employees have coverage for doctor visits and diagnostics, they are more likely to schedule regular check-ups. Early detection is the gold standard in medicine. Catching high blood pressure, diabetes, or other chronic conditions early through routine OPD visits can prevent severe complications down the road. This keeps your employees healthy and reduces the likelihood of high-value claims on your group health policy later.

Boosting Productivity

There is a direct link between health access and productivity. An employee suffering from a lingering ailment they are hesitant to treat due to cost is an employee who is not fully present or productive. By integrating employee OPD coverage into your corporate health insurance plans, you remove the barrier to care. Employees can see a doctor, get treated, and return to full health faster.

SwasthOPD understands that every organization is different. Integrating these plans isn’t just about paying bills; it’s about creating a culture of health. For more on how employee wellness contributes to better business outcomes, you can explore our Employee Wellness Solutions.

Corporate Wellness and Health Benefits: Beyond Basic Coverage

Health is multifaceted. It is not merely the absence of disease but a state of physical, mental, and social well-being. Consequently, a modern benefits package must extend beyond simple reimbursement for doctor visits. This is where the broader concept of Corporate Wellness and Health Benefits comes into play.

Corporate wellness programs act as a powerful supplement to traditional insurance. While insurance pays for sickness, wellness programs invest in health. These initiatives often encompass mental health support (such as therapy sessions or stress management workshops), fitness programs (gym memberships or yoga classes), nutritional counseling, and chronic disease management.

The Mental Health Component

The conversation around mental health in the workplace has shifted from a whisper to a roar. Burnout, anxiety, and stress are significant contributors to employee turnover and absenteeism. A comprehensive corporate wellness program must address these issues. SwasthOPD helps businesses integrate mental health benefits into their OPD plans, allowing employees to consult psychologists or psychiatrists without stigma or financial strain.

ROI on Wellness

Some employers view wellness programs as a “nice-to-have” perk rather than a strategic investment. However, the data suggests otherwise. Companies with robust wellness programs report fewer sick days, higher morale, and greater employee engagement. When an employee feels that their employer is invested in their long-term health, loyalty increases. It creates a psychological contract that goes deeper than a paycheck.

SwasthOPD helps businesses create wellness programs that are both affordable and impactful, ensuring that your investment yields tangible returns in workforce energy and efficiency. You can explore more about our corporate wellness solutions to help your business thrive.

Cashless OPD for Businesses: Removing Financial Friction

One of the biggest hurdles in traditional OPD reimbursement models is the process itself. Typically, an employee visits a doctor, pays upfront, collects the receipt, fills out a claim form, submits it to HR or the insurer, and then waits weeks for the money to hit their account. This process is tedious, time-consuming, and administratively heavy for your HR team. Worse, for lower-income employees, finding the cash upfront for expensive diagnostics or specialists can be a genuine hardship.corporate opd health insurance

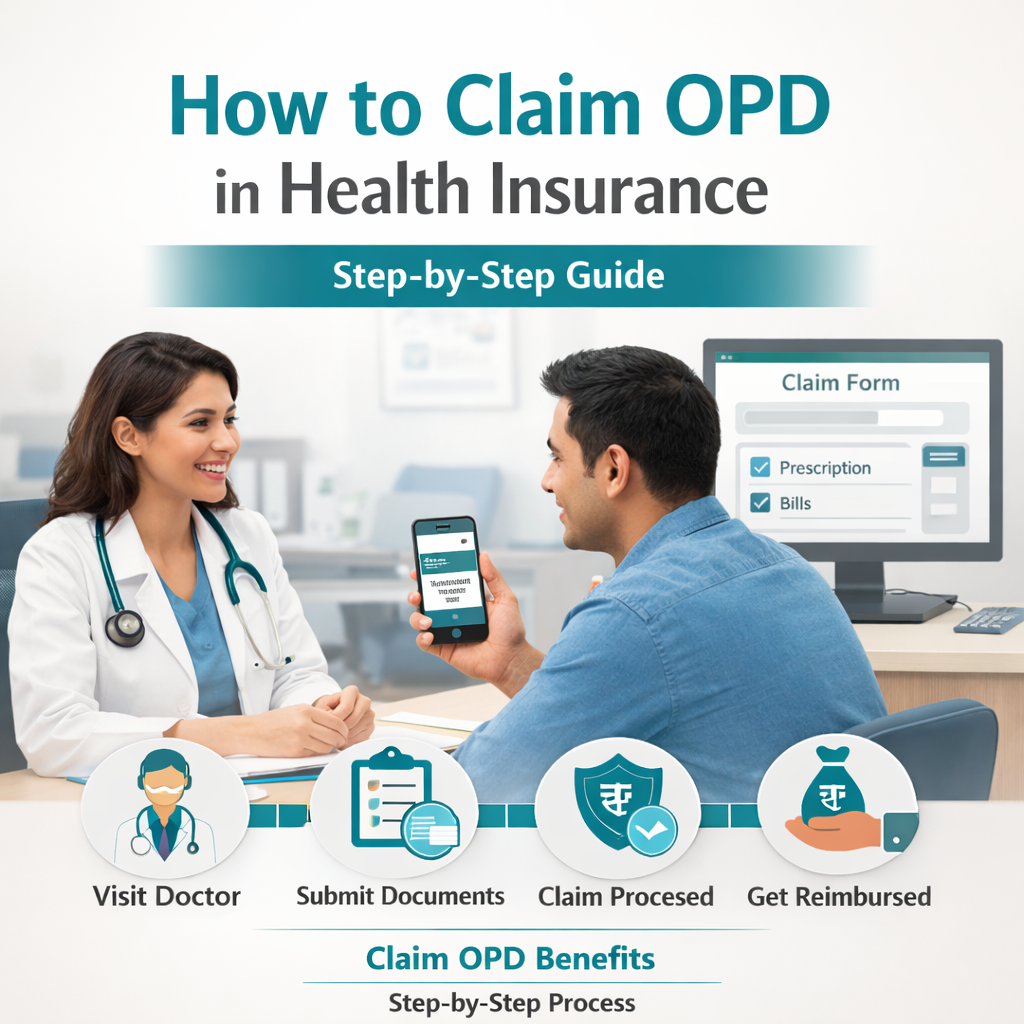

Cashless OPD for businesses solves this problem entirely. It streamlines the healthcare experience by removing the financial transaction from the point of care.

How Cashless OPD Works

With a cashless system, employees use a digital health card or an app provided by SwasthOPD to access services within a network of hospitals, clinics, and diagnostic centers. When they visit a network provider, they simply present their credentials. The provider bills the insurer directly. The employee pays nothing out of pocket (up to their limit), and there is no paperwork to file later.

The Benefits of Going Cashless

- Financial Accessibility: Employees do not need to dip into their savings to access care. This is crucial for junior staff or those living paycheck to paycheck. corporate opd health insurance

- Immediate Access: There is no hesitation to visit a doctor because of cash flow issues.

- Reduced Admin Burden: HR teams are often bogged down by managing reimbursement claims. Cashless systems digitize and automate this, freeing up HR to focus on strategic initiatives.

- Transparency: Digital transactions reduce the risk of fraudulent claims and provide businesses with better data on how their health benefits are being utilized.

By offering cashless OPD for businesses, companies ensure that their employees receive timely care without financial burden. To know more about how cashless services work, visit our plans page.

Tailored OPD Insurance for Employees: Customization is Key

No two businesses are the same, and neither are their workforces. A tech startup with an average employee age of 26 has vastly different health needs than a manufacturing firm with an average age of 45. The “one-size-fits-all” approach to insurance is a relic of the past. To truly provide value, companies need Tailored OPD Insurance for Employees.

Why Customization Matters

Off-the-shelf plans often suffer from two problems: they either over-insure (forcing you to pay for benefits your team won’t use) or under-insure (leaving critical gaps in coverage). Tailored insurance allows businesses to design a plan that fits their specific demographics, budget, and health risks.

Customization Options with SwasthOPD

SwasthOPD allows for deep customization of OPD plans. Here are a few ways you can tailor your coverage:

- Family Floaters: You can choose to extend OPD coverage to employees’ spouses, children, or dependent parents. This is a high-value perk that deeply resonates with employees who are primary caregivers.

- Specific Condition Coverage: If your workforce is older, you might prioritize coverage for chronic conditions like diabetes or hypertension management. For a younger workforce, you might focus on maternity benefits or dental and vision care.

- Teleconsultation Integration: For remote-first or hybrid companies, prioritizing unlimited teleconsultations might be more valuable than physical clinic visits.

- Wellness Wallets: Some tailored plans offer a “wellness wallet” approach, giving employees a set budget they can spend on a variety of health needs, from gym memberships to buying medicines, giving them the autonomy to choose what they need most.

Whether it’s offering coverage for specific health conditions or including family members in the plan, a customized OPD insurance plan ensures that employees get the most comprehensive care. For details on tailoring health plans for your business, visit our custom health plans section.

Frequently Asked Questions about Corporate OPD

What is the main difference between OPD and IPD coverage?

IPD (Inpatient Department) coverage requires hospitalization for at least 24 hours. It covers major surgeries and serious illnesses. OPD (Outpatient Department) coverage takes care of medical costs that do not require hospital admission, such as doctor consultations, dental treatments, and pharmacy bills.

Is Corporate OPD insurance mandatory for employers?

While basic health insurance is mandatory in some jurisdictions, OPD coverage is generally optional. However, it is highly recommended as a tool for retention and employee satisfaction.

Can OPD plans cover dental and vision?

Yes, most tailored corporate OPD plans can be customized to include dental procedures (like cleanings and fillings) and vision care (like eye exams and glasses), which are typically excluded from standard health insurance.

Does offering OPD insurance save the company money?

Indirectly, yes. By encouraging preventive care through OPD visits, you reduce the likelihood of employees developing severe conditions that lead to expensive hospitalization claims and long-term absenteeism.

Building a Healthier Future

Corporate OPD health insurance is not just a benefit; it is an essential part of a business’s strategy to promote employee well-being. In an era where employees value flexibility and support, a robust health plan acts as a tangible demonstration of your company’s values. corporate opd health insurance

By offering Employee OPD Coverage Plans, you ensure preventive care is accessible. By integrating Corporate Wellness and Health Benefits, you support the whole person, not just their physical ailments. By implementing Cashless OPD for Businesses, you remove financial barriers to entry. And by utilizing Tailored OPD Insurance for Employees, you ensure every dollar spent delivers maximum value to your unique workforce.

SwasthOPD provides solutions that are designed to meet the healthcare needs of modern organizations and their employees. Don’t let your benefits package fall behind the curve. Start building a healthier future today by exploring our comprehensive health plans.