Diagnostic Tests Insurance Cover: The Complete Guide to OPD Benefits

Healthcare costs in India are rising, and many expenses come from everyday medical needs like doctor visits, blood tests, and scans—costs often not covered by traditional health insurance. Most policies focus on hospitalization, leaving OPD expenses uncovered. This is where diagnostic tests insurance cover becomes essential, helping manage frequent medical costs that impact family budgets. With a proactive approach to healthcare, solutions like SwasthOPD enable individuals and families to handle these expenses more efficiently without financial strain.

What Is Diagnostic Tests Insurance Cover?

A diagnostic tests insurance cover is a type of health benefit that specifically pays for medical tests prescribed by a doctor that do not require hospitalization. Think of it as coverage for all the lab work and scans you get done at a clinic or diagnostic center. This includes a wide range of procedures essential for identifying illnesses, monitoring health, and preventing diseases.

These tests can range from common blood tests like a complete blood count (CBC) to more advanced radiology procedures such as MRIs, CT scans, and ultrasounds. It also covers preventive health check-ups, which are vital for early detection of potential health issues. Unlike standard health insurance that activates only when you are admitted to a hospital, this coverage helps manage the costs of your healthcare journey from the very first doctor’s visit.

Importance of Diagnostic Tests in Preventive Healthcare

Diagnostic tests are a cornerstone of modern preventive healthcare. They provide a window into your health, allowing doctors to catch problems before they become severe.

- Early Detection: Regular testing can identify diseases like diabetes, high cholesterol, and certain cancers in their earliest stages, when treatment is most effective and less costly.

- Cost Savings: Catching a health issue early often means simpler and more affordable treatment. This prevents the need for expensive, complex procedures or long-term hospitalization down the line.

- Chronic Disease Monitoring: For those with chronic conditions like thyroid disorders or heart disease, regular diagnostic tests are crucial for managing the illness and adjusting treatment plans as needed.

- Family Health Planning: Understanding your health status through tests helps in making informed lifestyle choices for you and your family, promoting long-term wellness for everyone. As the World Health Organization (WHO) emphasizes, early diagnosis is critical to improving health outcomes globally.

OPD Insurance Plans Explained

The term opd insurance plans refers to coverage designed for medical expenses that don’t require hospitalization. While regular health insurance focuses on inpatient care, OPD plans cover everyday needs such as doctor consultations, pharmacy bills, dental care, and diagnostic tests. In India’s high out-of-pocket healthcare system, OPD plans play a crucial role in making routine care affordable. For example, a plan from Swasth OPD can cover a doctor visit along with prescribed blood tests under one plan.

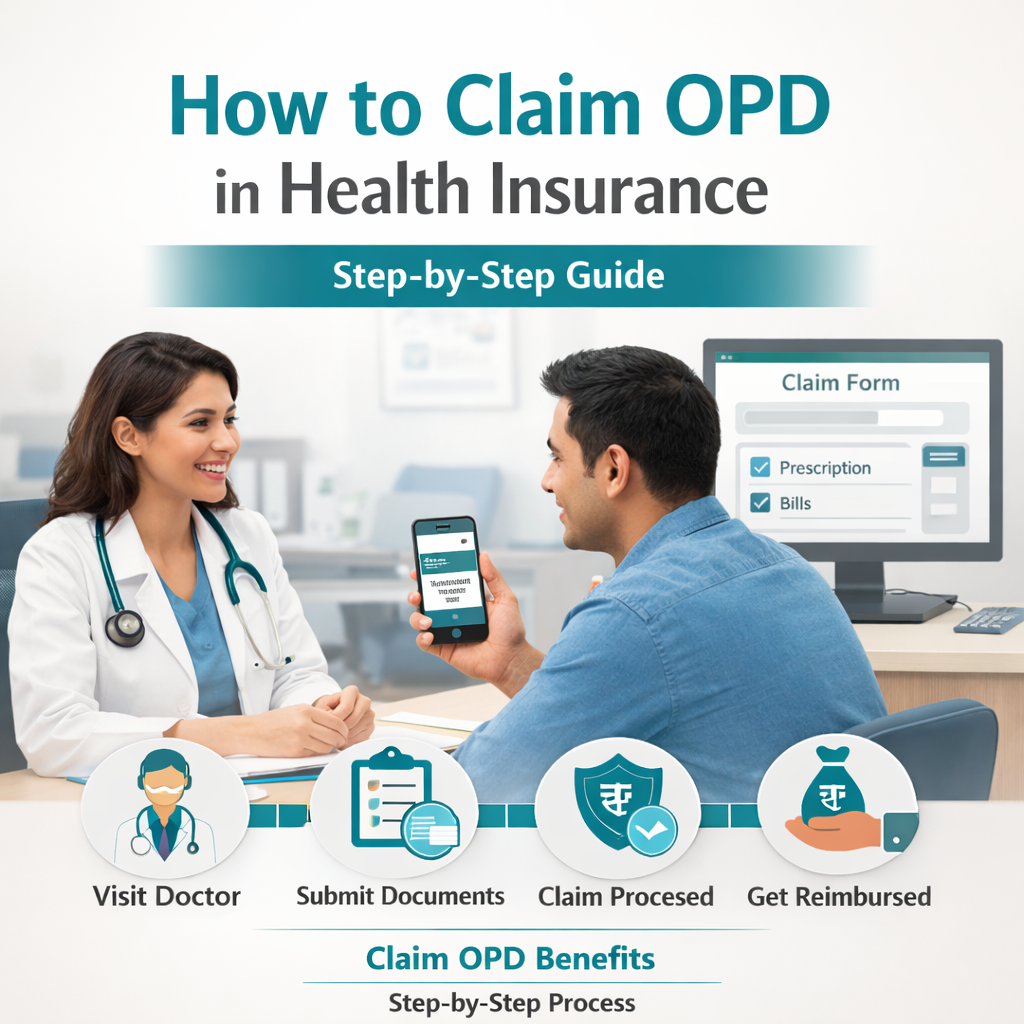

OPD Claim Means: How OPD Claims Work

Understanding what an opd claim means is simple—it refers to the process of getting your outpatient medical expenses covered by your insurer. OPD claims are usually straightforward and handled either through a cashless system, where bills are settled directly at network clinics or labs, or through reimbursement, where you pay first and claim later. For instance, with a cashless OPD plan, a prescribed X-ray at a partner lab can be done without any out-of-pocket payment.

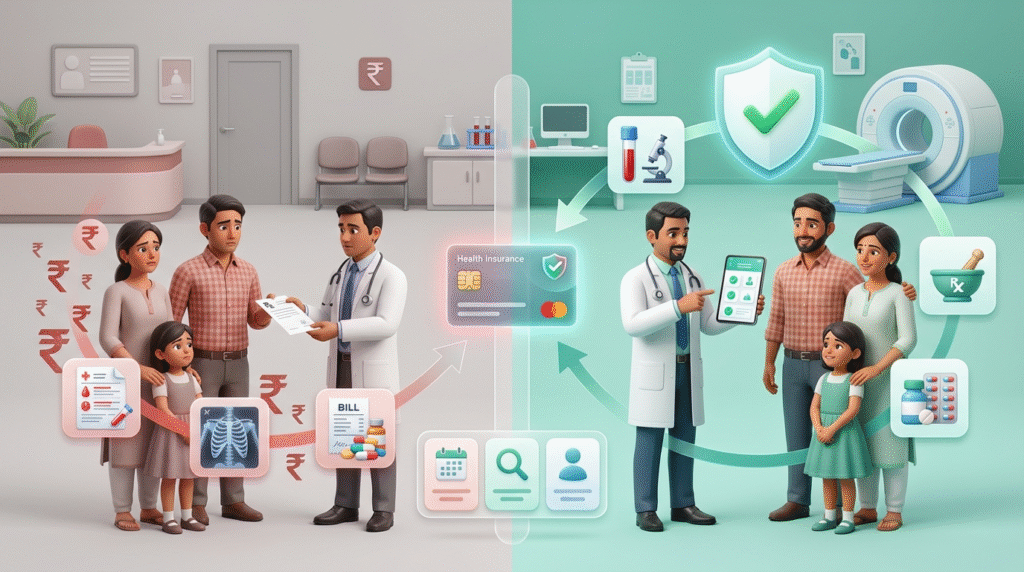

Understanding OPD Expenses in India

When we talk about opd expenses, we are referring to a broad category of medical costs that occur outside of a hospital stay. These are the most common healthcare costs for an average Indian family. The primary components include consultation fees for visiting a doctor or specialist, the cost of prescribed medicines from a pharmacy, and expenses for diagnostic tests like blood work, urine tests, X-rays, and scans. Individually, these costs might seem small. However, when you add them up over a year, especially for a family with children or elderly parents, the total can be substantial. Without any coverage, these recurring expenses can strain a household budget, sometimes forcing people to delay necessary check-ups and compromise their health.

How SwasthOPD Helps Cover Diagnostic Tests

SwasthOPD is designed to tackle the rising costs of out-patient care, with a strong focus on making diagnostic tests affordable. We offer plans that provide significant discounts on lab tests and radiology services through our extensive network of partner centers. This means you can get your essential tests done at a lower cost.

Our benefits are built around convenience and accessibility. With a cashless OPD system, you can walk into a network facility and get services without worrying about immediate payments. Everything can be managed through the SwasthOPD app, from finding a nearby lab to accessing your plan details. Whether you are an individual looking for a personal plan, a family needing comprehensive coverage, or a company wanting to provide valuable health benefits to your employees, SwasthOPD has a suitable and affordable solution. Explore our plans to see how you can start saving.

Who Should Opd for Diagnostic Tests Insurance Cover?

This type of coverage is beneficial for almost everyone, but it is particularly crucial for certain groups:

- Families: With children’s frequent doctor visits and routine check-ups for adults, families bear significant OPD costs throughout the year.

- Senior Citizens: The elderly require regular monitoring for chronic conditions, leading to frequent consultations and diagnostic tests. This cover helps manage these predictable expenses.

- Working Professionals: Busy professionals often neglect preventive health. An OPD plan encourages regular check-ups, helping them stay on top of their health without financial strain.

- Corporate Employees: Companies can offer OPD plans as a valuable employee benefit. It shows a commitment to employee wellness beyond just hospitalization and helps build a healthier, more productive workforce.

Common Myths About OPD & Diagnostic Coverage

There are several misconceptions surrounding OPD and diagnostic coverage that need to be addressed.

- Myth 1: “Diagnostics are always included in health insurance.”

This is not true. Most standard health insurance plans in India only cover expenses if you are hospitalized for at least 24 hours. Diagnostic tests as part of out-patient care are typically excluded. - Myth 2: “OPD plans are expensive.”

While it is an added policy, OPD plans are often quite affordable, especially when you consider the amount you save on consultations and tests over a year. The cost of a plan is often less than what a family would spend out-of-pocket. - Myth 3: “Claims are complicated.”

OPD claims, especially cashless ones, are designed to be quick and hassle-free. With providers like SwasthOPD, the process is often as simple as showing a digital health card at a network center.

FAQs

Is diagnostic tests insurance cover worth it?

Absolutely. Considering the high frequency of out-patient visits and lab tests, a diagnostic tests insurance cover can lead to significant savings annually. It promotes preventive care and ensures you don’t hesitate to seek medical advice due to costs.

Does OPD insurance cover blood tests?

Yes, most OPD insurance plans cover a wide range of diagnostic procedures, including common blood tests, urine analysis, and other lab work prescribed by a medical practitioner.

How is OPD different from Mediclaim?

Mediclaim is a traditional health insurance policy that primarily covers expenses related to hospitalization (in-patient care). OPD insurance, on the other hand, covers medical expenses that do not require hospitalization, such as doctor fees, pharmacy bills, and diagnostic tests.

Are OPD claims cashless?

Many modern OPD plans offer a cashless facility within their network of clinics, pharmacies, and diagnostic centers. However, some may also work on a reimbursement basis, so it’s important to check the terms of your specific plan.

Can corporates offer OPD insurance?

Yes, corporates can and increasingly do offer OPD insurance as part of their employee wellness programs. It is a highly valued benefit that helps employees manage their day-to-day healthcare expenses.

To understand how you can benefit from comprehensive OPD coverage, check out the affordable plans designed for your everyday healthcare needs. Visit the SwasthOPD homepage or contact us to learn more.