Medical inflation in India is rising at an alarming rate, often outpacing general inflation. While most families secure themselves with standard hospitalization covers, they often overlook a significant chunk of their medical expenses: Out-Patient Department (OPD) costs. From routine fever checks to dental consultations and diagnostic tests, these day-to-day expenses add up quickly, often burning a hole in your pocket because traditional insurance doesn’t cover them.

This is where health insurance for doctor visits becomes a game-changer. Unlike standard indemnity plans that kick in only when you are hospitalized for 24 hours or more, OPD-focused health plans cover your everyday medical needs. Whether it’s a consultation for a nagging cough, a regular diabetic check-up, or a prescribed pharmacy bill, having the right coverage ensures that your financial health stays as robust as your physical health.

What is Health Insurance for Doctor Visits?

Most people are familiar with hospitalization insurance, which covers major surgeries and inpatient treatments. However, health insurance for doctor visits is specifically designed to cover medical expenses that do not require hospital admission.

These plans typically cover:

- General Physician & Specialist Consultations: Fees paid to doctors for diagnosis and advice.

- Diagnostic Tests: Blood tests, X-rays, MRI scans, and other pathology or radiology services.

- Pharmacy Bills: Cost of medicines prescribed by a medical practitioner.

- Preventive Health Check-ups: Annual body check-ups to monitor overall health.

- Dental and Vision Care: often excluded in standard policies but covered under specific OPD plans.

In the Indian context, where nearly 60% of healthcare expenditure is out-of-pocket (primarily OPD), these plans bridge the gap between expensive comprehensive insurance and actual daily medical needs.

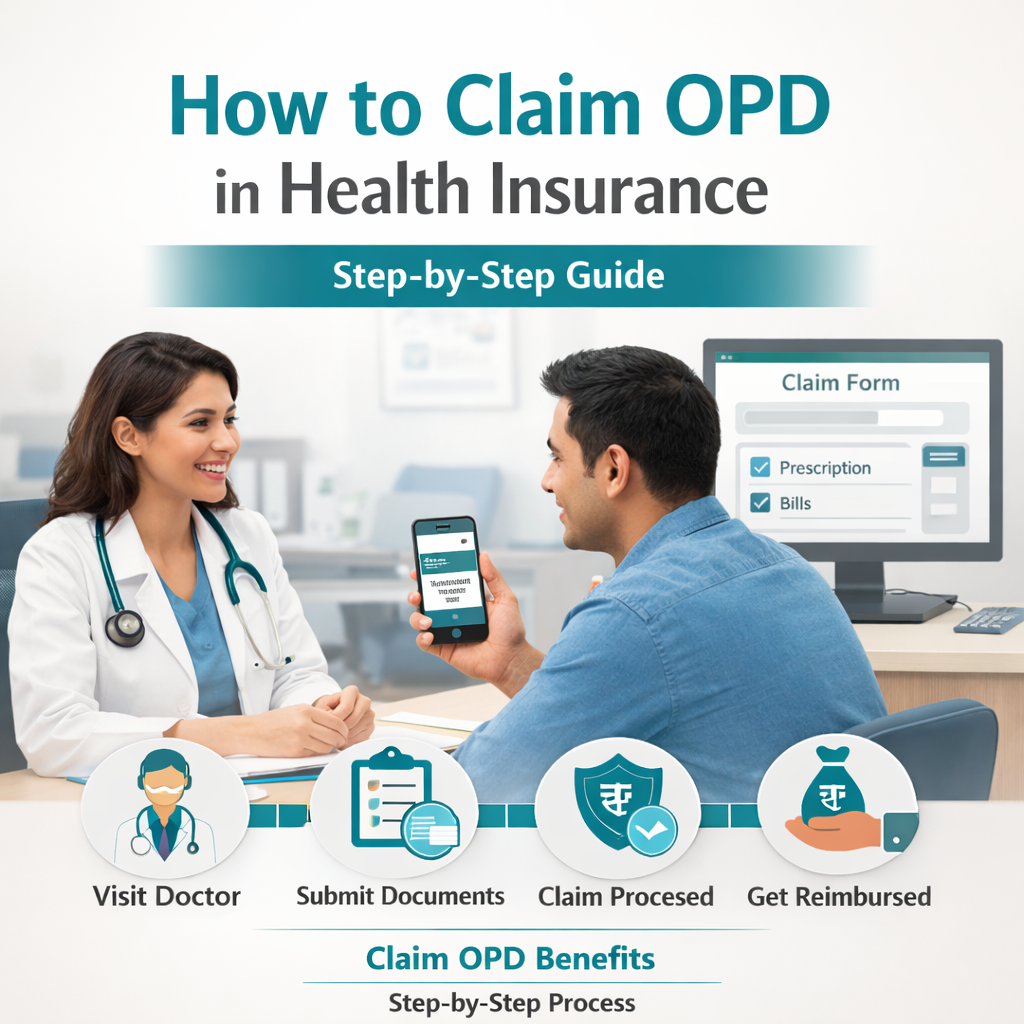

Cashless Doctor Consultation Insurance

One of the biggest hurdles in accessing OPD care is the payment process. Usually, patients have to pay cash upfront and then file for reimbursement—a tedious process for small amounts. Cashless doctor consultation insurance solves this by allowing you to walk into a network clinic and consult a doctor without paying a single rupee at the counter.

Imagine your child has a sudden high fever. With a cashless plan, you can visit a pediatrician within your insurer’s network, get the consultation done, and leave without worrying about the bill. This model is gaining immense popularity in India because it removes the financial friction from seeking immediate medical advice. At SwasthOPD, we prioritize this convenience, ensuring that your focus remains on recovery rather than managing receipts and reimbursement forms.

Insurance for OPD Doctor Visits

When we talk about insurance for OPD doctor visits, we aren’t just talking about saving money; we are talking about promoting a culture of preventive healthcare. Many Indians delay seeing a doctor because of the consultation fees, which can range from ₹500 to ₹2000 in metro cities. This delay often aggravates minor conditions into major ailments requiring hospitalization.

Insurance that specifically covers these visits encourages timely medical intervention. Whether it is managing chronic conditions like hypertension and diabetes or addressing acute seasonal illnesses, having insurance for OPD doctor visits ensures you never hesitate to seek professional medical advice. It effectively acts as a financial shield for the frequent, low-cost transactions that collectively drain your savings over a year.

Health Plan Covering Doctor Consultation

Finding a comprehensive health plan covering doctor consultation can be confusing given the myriad of options in the market. A robust plan should offer flexibility. It shouldn’t just restrict you to a general physician but should also include access to specialists like dermatologists, cardiologists, and pediatricians.

Furthermore, with the rise of digital health, a good plan today must integrate telemedicine. This allows you to consult top doctors via video call from the comfort of your home—a crucial benefit for senior citizens or working professionals with tight schedules. Swasth OPD’s plans are designed with this hybrid approach in mind, offering both in-person and tele-consultation credits to suit your lifestyle needs.

Affordable OPD Health Insurance India

For a long time, OPD coverage was considered a luxury add-on, available only in premium, high-premium policies. However, the landscape has changed. Today, there is a growing demand for affordable OPD health insurance India can rely on. These new-age plans are democratic, designed for the middle-class family that wants protection against rising medical costs without paying exorbitant premiums.

Affordability doesn’t mean compromising on quality. It means smarter packaging of benefits—bundling pharmacy discounts, free tele-consultations, and network discounts on diagnostics—to lower the overall cost of care. By focusing on high-volume, low-value transactions, providers can offer cost-effective solutions that save you thousands annually.

Why Traditional Health Insurance is Not Enough for OPD Care

While traditional Mediclaim policies are essential for protecting against catastrophic financial loss due to surgeries, they are woefully inadequate for daily health management.

- The Waiting Game: Most traditional policies have waiting periods for pre-existing diseases, and OPD benefits, if available, often come with a waiting period of 2-4 years.

- High Out-of-Pocket Expenses: As mentioned earlier, the majority of Indian healthcare spending is on medicines and consultations. Traditional insurance leaves you to bear 100% of this burden.

- Claims Complexity: Filing a reimbursement claim for a ₹800 doctor’s fee is often more hassle than it’s worth. The paperwork, courier costs, and processing time discourage policyholders from utilizing small benefits.

- Lack of Preventive Focus: Traditional plans react to illness (hospitalization); they rarely proactively manage health through regular doctor visits.

How SwasthOPD Solves OPD Healthcare Gaps

At SwasthOPD, we understand that healthcare is a daily necessity, not just an emergency event. We have tailored our services to fill the void left by traditional insurers.

- Cashless Convenience: We offer cashless OPD consultations, removing the burden of upfront payments.

- Tele-Doctor Services: Access qualified doctors instantly through our platform, saving travel time and waiting room anxiety.

- Holistic Savings: Our plans provide substantial discounts on diagnostics and pharmacy bills, ensuring comprehensive coverage.

- Affordable Plans: Whether you are an individual or looking for corporate wellness solutions, we have affordable OPD plans that fit every budget.

- Mental Health Support: We recognize the importance of mental well-being and include support for it in our comprehensive health assistance.

With over 12 years of experience, we don’t just sell plans; we partner with you in your journey toward better health.

Who Should Choose OPD-Based Health Insurance?

Opting for an OPD-focused plan is a smart financial move for almost everyone, but it is particularly beneficial for:

- Families with Young Children: Kids require frequent visits to pediatricians for vaccinations, seasonal flus, and growth check-ups.

- Senior Citizens: Elderly parents often require regular monitoring for chronic conditions, physiotherapy sessions, and prescription refills.

- Working Professionals: Stress and lifestyle diseases are common. Quick access to tele-consultations and mental health support is vital for this demographic.

- Corporate Employees: Companies can enhance employee satisfaction significantly by offering OPD benefits that employees can actually use regularly, unlike hospitalization covers they hope never to use.

Conclusion

Investing in health insurance for doctor visits is investing in proactive health management. It shifts the narrative from “treating illness” to “maintaining wellness.” By covering the costs of consultations, medicines, and diagnostics, these plans ensure that financial constraints never stop you from getting the care you need, when you need it.

Don’t let daily medical bills eat into your savings. Take charge of your health today with a partner who understands your day-to-day needs. Contact SwasthOPD to explore personalized plans that offer the perfect blend of affordability and comprehensive care.