Making payments for things like doctor visits, diagnostic tests, and pharmacy bills every day can be a constant drain on your finances. Most people have health insurance, but these plans usually only cover the costs of hospitalization (IPD), which leaves a big gap for regular outpatient care. Health Insurance with OPD Cover helps fill this gap by paying for doctor visits, tests, and treatments that don’t require hospitalization, so you don’t have to pay for most of your healthcare needs out of your own pocket.

What is a Health Insurance Plan with OPD Cover?

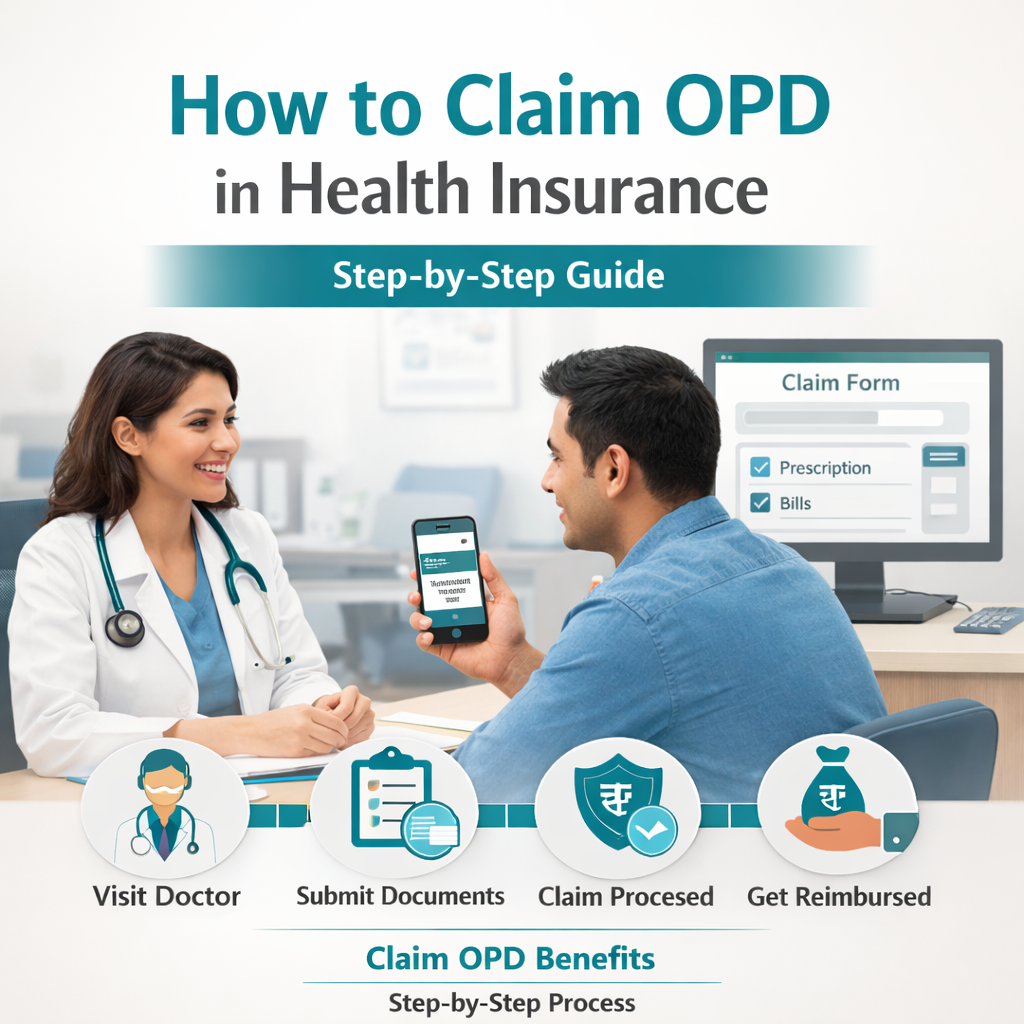

A health insurance plan with OPD cover is designed to pay for medical expenses that do not require hospitalization. This includes doctor consultations, prescribed medicines, diagnostic tests, and other outpatient services. Unlike standard health insurance that only activates when you are admitted to a hospital, an OPD insurance plan helps you manage the frequent, smaller costs associated with staying healthy.

The main purpose of this type of coverage is to make preventive and routine care more affordable. By offering benefits for services like telehealth, doctor consultations, and wellness programs, these plans encourage you to address health issues early, before they become serious. For a clearer understanding of the differences, you can read our detailed breakdown of OPD vs. IPD services.

Key Benefits of a Medical Insurance with OPD Cover

An OPD cover insurance plan offers several advantages that traditional policies lack. It shifts the focus from reactive treatment to proactive wellness, ensuring you have the support you need for everyday health concerns.

Financial Relief from Daily Medical Costs

The most immediate benefit is saving money on regular medical expenses. With an OPD insurance plan, costs for doctor visits, prescribed medications, and lab tests are covered, reducing your financial burden. This is especially important as these smaller expenses can add up significantly over a year. Modern plans, particularly cashless OPD plans, are making healthcare more manageable by eliminating out-of-pocket payments.

Encourages Preventive Healthcare

When you have health insurance with OPD cover, you are more likely to seek medical advice for minor issues or go for regular check-ups. This proactive approach helps in the early detection of potential health problems, leading to better outcomes and lower long-term medical costs. This model is crucial for making healthcare affordable in India.

Comprehensive Wellness Benefits

Many modern OPD insurance plans go beyond just doctor visits. They often include:

- Telehealth services: 24/7 access to doctor consultations from home.

- Mental health support: Coverage for therapy and counseling sessions.

- Fitness and lifestyle programs: Access to gym memberships, yoga classes, and nutrition guidance.

- Diagnostic services: Coverage for a wide range of tests and screenings.

These features provide a holistic approach to health, supporting not just your physical but also your mental and emotional well-being.

How SwasthOPD Experts Help You Get These Benefits

Choosing the right medical insurance with OPD cover can seem complicated, but you don’t have to do it alone. The experts at SwasthOPD are here to guide you every step of the way.

Our team takes the time to understand your unique health needs and budget. We then help you select or create a personalized plan that provides the right benefits for you, your family, or your employees. Whether you need an individual plan or a corporate wellness solution, our experts ensure your coverage is perfectly matched to your requirements. We specialize in creating personalized plans for both individuals and corporates, ensuring everyone gets the care they deserve.

With SwasthOPD, you gain a trusted partner committed to your health. Our goal is to provide you with a seamless and affordable healthcare experience, backed by expert advice and 24/7 support.

Take Control of Your Healthcare Costs

Securing your health should not be limited to emergencies. A health insurance plan with OPD cover provides a safety net for your daily medical needs, promoting a healthier lifestyle and offering financial peace of mind. By covering services from doctor consultations to wellness programs, it ensures you are prepared for every aspect of your health journey.

Ready to find the perfect OPD insurance plan? Explore the comprehensive and affordable health solutions offered by SwasthOPD and take the first step towards smarter healthcare management today.