Healthcare expenses have a way of sneaking up on you. While most families are prepared for major medical emergencies involving hospitalization, the smaller, recurring costs—like dental checkups, fever consultations, or routine blood tests—often fly under the radar. In India, these Outpatient Department (OPD) expenses account for a massive chunk of total healthcare spending, yet they are rarely covered by standard health insurance policies. So, how does cashless OPD work? It offers a solution to these ongoing costs, making healthcare more accessible and affordable for everyone.

This is where the concept of cashless OPD steps in to change the narrative.

But what exactly is it? Cashless OPD is a mechanism that allows patients to walk into a clinic, consult a doctor, get diagnostic tests done, and pick up prescribed medicines without paying cash upfront. Instead of the patient settling the bill and chasing an insurance company for reimbursement later, the service provider (like SwasthOPD) settles the bill directly with the healthcare network.

The demand for these services is skyrocketing. As medical inflation rises, individuals are looking for ways to protect their savings from the “slow bleed” of routine medical costs. SwasthOPD aims to bridge this gap, simplifying the healthcare journey by making it accessible, efficient, and, most importantly, affordable for everyone. By removing the financial friction from everyday doctor visits, we are helping families prioritize their health without worrying about their wallets.

Benefits of Cashless OPD Services

When you think of health insurance, you likely picture a hospital bed, surgery, and a large bill. However, OPD services are what you use most frequently. Shifting these frequent visits to a cashless model offers transformative advantages for patients.

Immediate Financial Relief

The most obvious benefit is the protection of your liquidity. A sudden viral fever or a persistent toothache shouldn’t force you to dip into your monthly household budget. With cashless OPD, the financial transaction happens in the background. You get the care you need immediately, without the stress of an unexpected expense.

Encourages Preventative Care

One of the hidden benefits of cashless OPD services is that it encourages people to visit the doctor sooner rather than later. When you have to pay out-of-pocket, it is human nature to delay a consultation, hoping the symptom will go away on its own. This delay often leads to the condition worsening, eventually requiring expensive hospitalization. When the consultation is cashless, the hesitation disappears. You are more likely to seek early intervention, leading to better long-term health outcomes.

Zero Paperwork Hassles

The traditional reimbursement model is tedious. It involves collecting bills, filling out claim forms, submitting physical copies, and waiting weeks for the money to hit your account. A cashless system eliminates this administrative burden entirely. The authorization happens digitally and instantly, saving you time and effort.

Comprehensive Coverage

Modern cashless OPD plans often go beyond just the doctor’s fee. Depending on the plan you choose, coverage can extend to diagnostic tests (like MRIs or blood work) and pharmacy expenses. This holistic approach ensures that the entire episode of care is covered, not just the conversation with the doctor.

If you are looking for a plan that covers your specific needs, explore the [Swasth OPD plans page] to find a package that suits your lifestyle and budget.

Cashless OPD Insurance Coverage Details

Understanding the nuances of insurance can be tricky. While hospitalization (IPD) coverage is standard, OPD coverage is a newer, evolving product in the Indian market. So,how does cashless OPD work? within the framework of insurance?

It operates on a network basis. Insurance companies or health-tech platforms partner with a specific network of hospitals, clinics, and diagnostic centers. When you visit a facility within this network, the “cashless” protocol is activated.

What is typically covered?

- General Physician & Specialist Consultations: Whether it’s a general practitioner for a flu or a cardiologist for a checkup, fees are covered up to your plan’s limit.

- Diagnostic Services: Radiology and pathology tests prescribed by the doctor are often included.

- Pharmacy: Some comprehensive plans cover the cost of prescribed medicines.

- Dental and Vision: These are often excluded from standard indemnity policies but are increasingly included in specialized OPD plans.

Understanding Limits and Exclusions

Unlike IPD policies which might have a sum insured of several lakhs, OPD coverage usually operates on a defined limit per year (e.g., ₹10,000 or ₹20,000). It is crucial to read the fine print regarding:

- Waiting Periods: Some plans allow you to use OPD benefits immediately, while others may have a short waiting period.

- Network Restrictions: Cashless service is generally only available at network providers. If you go outside the network, you may not get coverage, or you might be forced to use the reimbursement route.

- Sub-limits: There might be specific caps on how much you can spend on dental versus general medicine.

For a deeper dive into what your policy might entail, visit our [Plans page]. It’s vital to understand these cashless OPD insurance coverage details to maximize your benefits and avoid surprises at the clinic desk.

For a broader understanding of how health insurance regulations are evolving to include more OPD benefits, you can read this guide on General Health Insurance regulations in India.

How to Avail Cashless OPD in India

India is undergoing a digital healthcare revolution. The integration of technology with healthcare services has made availing cashless facilities smoother than ever before. But for a new user, the process might still seem unfamiliar.

The Role of Health Cards and Apps

To avail of these services, identification is key. In the past, this meant carrying a physical card. Today, platforms like SwasthOPD have digitized this experience. Your smartphone is your ID. When you ask, “how does cashless OPD work? in a practical scenario?”, the answer almost always involves a mobile app or a digital health card.

Choosing the Right Provider

The first step is selecting a healthcare provider that accepts your plan. This is easier than it sounds. Most platforms provide a “Doctor Locator” or “Network Search” tool. You can filter by specialty, location, and even review ratings.

The Verification Process

Once you arrive at the clinic, the process of verification begins. The front desk will verify your active membership status. In a reimbursement model, this doesn’t happen—you just pay and leave. In a cashless model, the clinic’s system communicates with SwasthOPD’s system to confirm you have the necessary balance or coverage limit available.

Navigating Non-Network Situations

It is important to note that if you are in a remote area or choose a doctor who is not on the panel, how to avail cashless OPD in India becomes difficult. In such cases, you might not be able to use the cashless facility. This highlights the importance of choosing a plan with a robust, wide-reaching network of doctors and clinics.

Ready to get started? Visit our [User registration page] to create your account and browse the network of doctors available in your area.

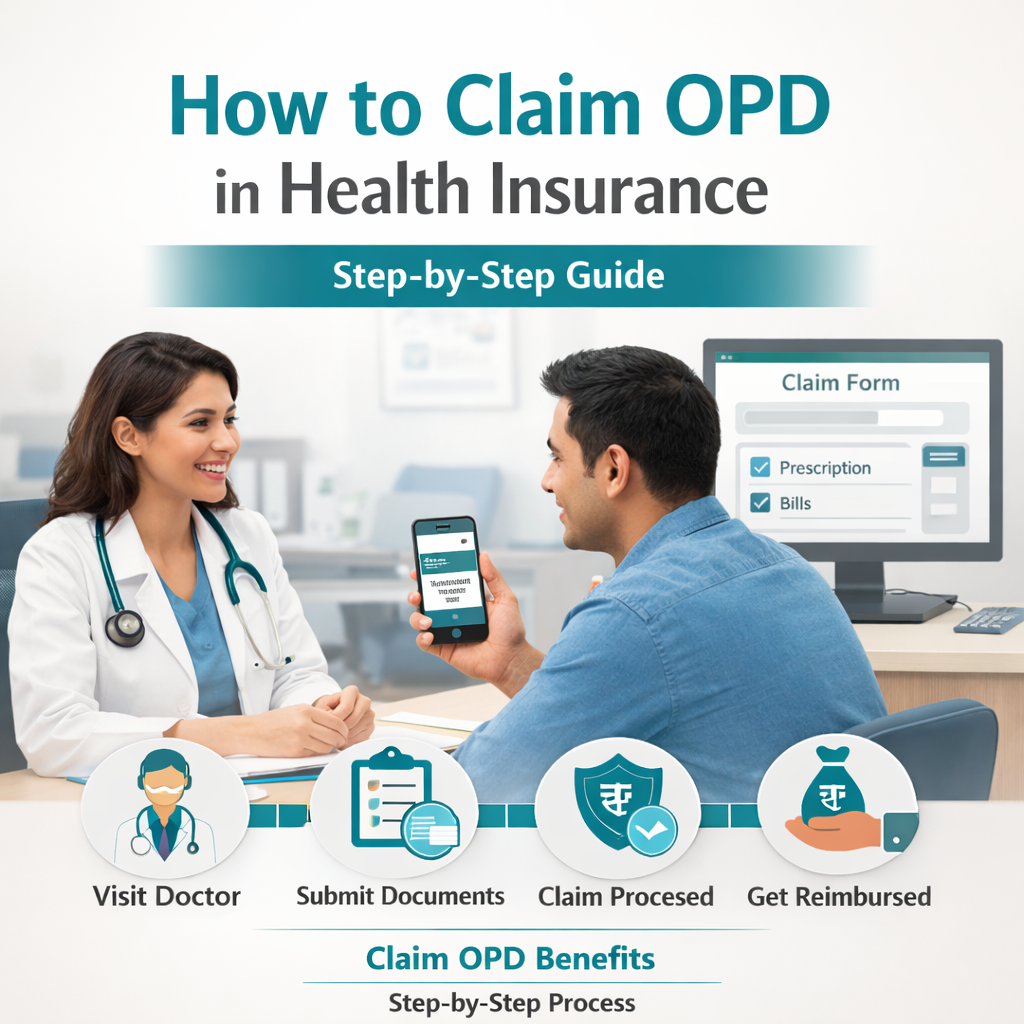

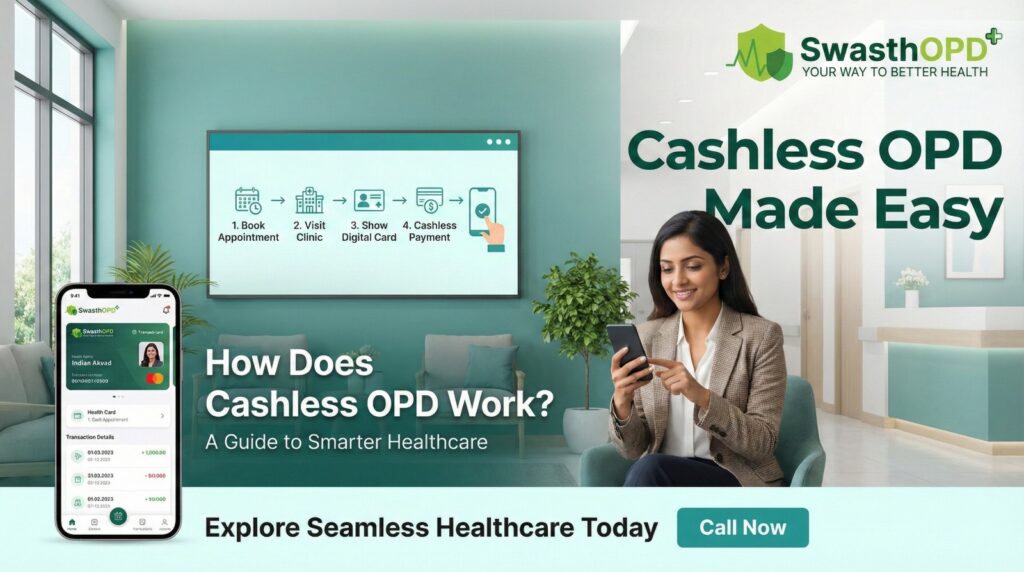

Steps to Use Cashless OPD for Consultations

So, you have purchased a plan and you are ready to see a doctor. Here is a granular, step-by-step walkthrough of what the experience looks like on the ground. This guide ensures you know exactly what to do from the moment you feel unwell to the moment you leave the clinic.

Step 1: Login and Search

Open the SwasthOPD app or website. Log in to your account. Use the search bar to find the type of specialist you need (e.g., Orthopedic, Pediatrician). You will see a list of doctors near you who accept cashless payments.

Step 2: Book the Appointment

While some clinics accept walk-ins, it is highly recommended to book through the portal. This alerts the clinic that a cashless patient is arriving. Select your preferred time slot and confirm the booking. You should receive a confirmation ID or a digital token.

Step 3: Visit the Clinic

Arrive at the clinic on time. Inform the reception desk that you have an appointment via SwasthOPD. Present your digital health card or the appointment confirmation on your phone.

Step 4: Authorization Request

This is the technical part of “how does cashless OPD work?”. The clinic staff will enter your details into their portal to request authorization for the consultation fee. This request hits the SwasthOPD server, which checks your available balance and policy validity. This usually takes just a few minutes.

Step 5: The Consultation

Once authorized, you proceed to see the doctor. The medical checkup happens exactly as it would for a cash-paying patient. There is no difference in the quality of care.

Step 6: Post-Consultation Services

If the doctor prescribes medication or tests, check if your plan covers cashless fulfillment for these as well. If yes, the clinic or the attached pharmacy will initiate a second authorization request for those specific costs.

Step 7: Settlement and Exit

Once you are done, simply sign the invoice or digital receipt generated by the clinic to acknowledge the service. You do not need to pull out your wallet. The clinic sends the bill to us, and we handle the payment.

Navigating these steps to use cashless OPD for consultations is designed to be intuitive. However, having the app handy makes it significantly easier. Download the app via our [SwasthOPD app page] to manage your appointments and track your usage history on the go.

Why Healthcare Needs to Be Frictionless

The traditional model of healthcare payments is fraught with friction. It requires liquidity at the moment of distress, which adds anxiety to an already stressful situation. By asking “how does cashless OPD work?” and adopting this model, you are effectively removing a barrier to your own well-being.

SwasthOPD is committed to building an ecosystem where healthcare is not just a service, but a seamless experience. Whether it is a routine dental cleanup or a recurring diabetic checkup, the cashless route offers dignity, speed, and financial prudence.

Take Charge of Your Health Today

The transition to cashless OPD is more than just a financial convenience; it is a lifestyle change that prioritizes health. It ensures that cost is never a deterrent to seeking medical advice.

Don’t wait for an emergency to think about your healthcare strategy. Explore the various plans SwasthOPD offers and join the thousands of Indians who have switched to a smarter, cashless way of managing their health. Whether you need individual coverage or a family floater plan, we have options tailored for you.

Visit SwasthOPD today to learn more about our exclusive offers and start your journey toward stress-free healthcare.