How to choose the best OPD plan for your family

Keeping your family healthy is a top priority, but navigating the world of health insurance can be overwhelming. Standard health insurance often focuses on hospitalization (IPD), leaving you to pay for day-to-day medical expenses like doctor visits, tests, and medicines out of your own pocket. This is where Out-Patient Department (OPD) plans come in, offering a smart way to manage these routine healthcare costs.

Choosing the right OPD plan is crucial for ensuring your family gets the care they need without financial stress. But with so many options available, how do you know which one is the best fit? This guide will walk you through everything you need to know about selecting the ideal OPD plan for your family’s unique needs. We will cover the key benefits, how different features work, and what to look for to make an informed decision.

What are the benefits of OPD health insurance?

Before we look at how to choose a plan, it’s important to understand why an OPD plan is so valuable for your family. Unlike traditional health insurance that covers you only when you’re admitted to a hospital, OPD plans cover the medical expenses you incur without being hospitalized. These are the costs that families face most frequently.

Here are some of the key benefits:

- Manages Routine Expenses: An OPD plan helps cover the costs of regular doctor consultations, diagnostic tests, and pharmacy bills. This means fewer out-of-pocket expenses for common illnesses like fever, coughs, and colds.

- Promotes Preventive Care: With coverage for regular check-ups, families are more likely to seek preventive care. This helps in the early detection of potential health issues, leading to better health outcomes in the long run.

- Offers Financial Predictability: By covering frequent medical costs, an OPD plan helps you budget for your family’s healthcare needs more effectively. It provides a safety net against unexpected expenses from frequent but minor health problems.

- Provides Comprehensive Wellness: Many OPD plans, like those from SwasthOPD, offer more than just doctor visits. They often include benefits like unlimited tele-consultations, discounts on gym memberships, and mental health programs, promoting a holistic approach to wellness.

How to choose the best OPD plan for your family

Selecting the right plan requires careful consideration of your family’s specific healthcare needs. Here are the key factors you should evaluate to find the perfect match.

1. Assess Your Family’s Healthcare Needs

Every family is different. A family with young children will have different medical needs than a family with older parents. Start by listing the healthcare services your family uses most often.

- Frequency of Doctor Visits: How often do your family members visit a general physician or specialist? If you have children or elderly parents, you might need frequent consultations.

- Diagnostic Tests: Do any family members have chronic conditions that require regular blood tests or other diagnostic procedures?

- Pharmacy Expenses: Consider your family’s monthly spending on prescribed medicines.

- Dental and Vision Care: Check if the plan covers routine dental check-ups or vision care, as these are common needs.

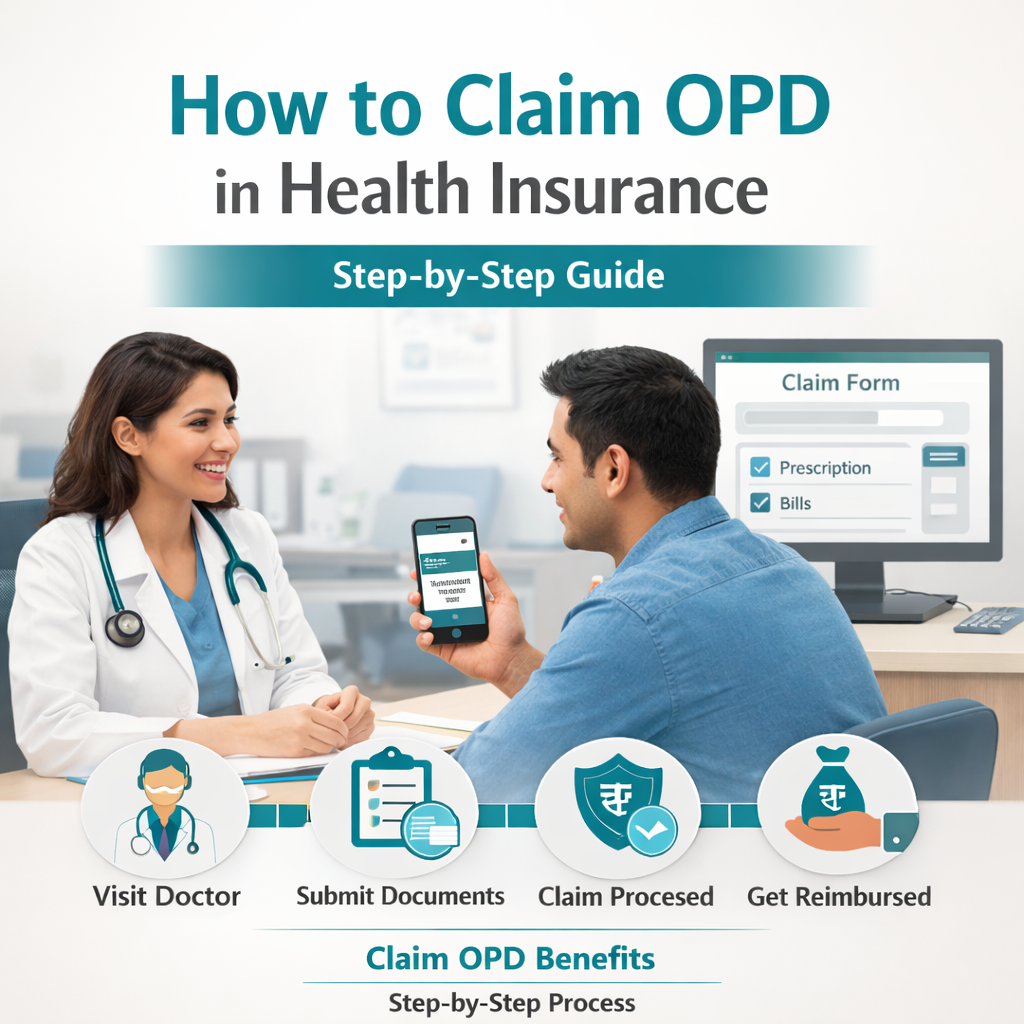

2. Understand Coverage and Sub-Limits

Once you know your needs, look closely at what each plan offers. Don’t just look at the overall sum insured; the details are what matter.

- Coverage for Consultations: Does the plan cover both general physician and specialist consultations? Look for plans that offer unlimited tele-consultations, which can be incredibly convenient.

- Diagnostic and Pharmacy Discounts: Check the percentage of discount offered on diagnostic tests and medicines. A higher discount can lead to significant savings.

- Network of Hospitals and Clinics: Ensure the plan has a wide network of partner clinics, hospitals, and diagnostic centers in your area. SwasthOPD’s network, for example, includes over 600 doctors and 220+ hospitals.

3. Evaluate the Cashless Feature

One of the biggest advantages of modern OPD plans is the cashless facility. This feature simplifies the entire process of receiving medical care.

- How does cashless OPD work? With a cashless plan, you don’t need to pay upfront at network hospitals or clinics. The insurance provider settles the bill directly with the healthcare provider. This is a hassle-free experience, especially during a stressful medical situation.

- Network Strength: The effectiveness of a cashless facility depends on the provider’s network. A strong network ensures you can easily find a participating clinic or pharmacy nearby.

4. Look for Additional Wellness Benefits

A good OPD plan should support your family’s overall well-being. Look for plans that go beyond basic medical coverage. SwasthOPD offers personalized health plans that include:

- Unlimited tele-doctor consultations

- Discounts on gym memberships

- Mental and physical wellness programs

- At-home dental scans

These extra benefits can provide immense value and help your family maintain a healthy lifestyle.

Answering Your Key Questions

When choosing an OPD plan, you might have a few specific questions. Let’s address some common ones.

Can I buy OPD-only insurance?

Yes, you can. Many providers now offer standalone OPD plans that are not tied to a traditional hospitalization policy. These plans are specifically designed to cover outpatient expenses and are an excellent option for families who want to manage their day-to-day healthcare costs separately.

Is medicine covered in OPD insurance?

Most comprehensive OPD plans do offer coverage for prescribed medicines. This is usually provided as a discount at partner pharmacies. When selecting a plan, check the extent of the pharmacy benefits and the network of pharmacies where you can avail the discount. This is a crucial feature that can significantly reduce your monthly medical expenses.

How a SwasthOPD Expert Can Help

Navigating the world of OPD plans can still feel complex, but you don’t have to do it alone. The experts at SwasthOPD are dedicated to helping you find the perfect health plan for your family. Our team can:

- Analyze Your Needs: We’ll help you assess your family’s specific health requirements to identify the most suitable coverage.

- Explain Plan Details: Our experts will walk you through the specifics of different plans, like the Swasth Life Plan, explaining coverage, benefits, and any exclusions in simple terms.

- Customize Your Plan: We believe that one size doesn’t fit all. We can help you create your own plan to ensure it aligns perfectly with your family’s needs and budget.

Secure Your Family’s Health Today

Choosing the best OPD plan for your family is a vital step towards securing their health and well-being. By focusing on your family’s needs, understanding the details of the coverage, and looking for valuable wellness benefits, you can make a choice that provides both financial security and peace of mind. An OPD plan isn’t just an expense; it’s an investment in your family’s long-term health.

Ready to find the perfect plan for your loved ones? Contact SwasthOPD today and let our experts guide y