Health insurance is often associated with major medical events that require hospitalization. However, a significant portion of healthcare expenses comes from routine medical needs like doctor visits, diagnostic tests, and pharmacy bills. This is where Outpatient Department (OPD) coverage becomes essential. OPD cover is a valuable feature in modern health insurance policies, allowing you to manage day-to-day medical costs without being admitted to a hospital. This guide will walk you through the specifics of OPD benefits and explain exactly how to claim OPD in health insurance. If you’re new to the world of health insurance, understanding how to claim OPD in health insurance can help you make the most of your policy benefits and avoid unnecessary expenses.

What is OPD Cover in Health Insurance?

OPD cover in health insurance pays for medical expenses incurred without hospitalization. To understand its value, it’s important to distinguish between inpatient and outpatient care. Inpatient care is for patients admitted to a hospital for at least 24 hours. Outpatient care, on the other hand, is for treatments and consultations at a doctor’s clinic, hospital OPD, or diagnostic center where you are not admitted.

When you’re exploring how to claim OPD in health insurance, you’ll find that OPD coverage typically includes a range of services, such as:

- Doctor consultation fees

- Diagnostic tests like blood work, X-rays, and MRIs

- Pharmacy expenses for prescribed medications

- Minor surgical procedures that don’t require hospitalization

- Dental treatments and eye care in some plans

By covering these routine expenses, OPD benefits make healthcare more accessible and affordable. Understanding the process of how to claim OPD in health insurance ensures you can make the most of your policy and reduce your out-of-pocket spending on regular health needs. Whether it’s your first time submitting a claim or you’re looking for ways to optimize your coverage, knowing specifically how to claim OPD in health insurance positions you to benefit the most from your plan.

Health Insurance Plans with OPD Coverage

Many insurers now offer health insurance plans with OPD cover as either a built-in feature or an optional add-on. These plans are designed to provide comprehensive financial protection that goes beyond just hospitalization. Understanding how to claim OPD in health insurance for different plans can help you take advantage of everything your policy offers. Including OPD benefits acknowledges that a person’s health journey involves frequent, smaller expenses that can add up over time.

For example, plans like our SwasthOPD Plans are specifically designed to cater to these needs. Having this coverage means you are less likely to postpone a necessary doctor’s visit or diagnostic test due to cost concerns. Since knowing how to claim OPD in health insurance is part of getting the most from your plan, it’s important you are aware of each step involved. This proactive approach to health can lead to earlier detection of illnesses and better long-term health outcomes. Whether you are considering a SwasthOPD Life Plan or a Basic Plan, adding OPD coverage enhances your financial security.

Looking for more helpful articles? Visit our Blog page or reach out with questions through our Contact page.

How to Claim OPD Benefits in Your Health Insurance Policy

Looking for more helpful articles? Visit our Blog page or reach out with questions through our Contact page.

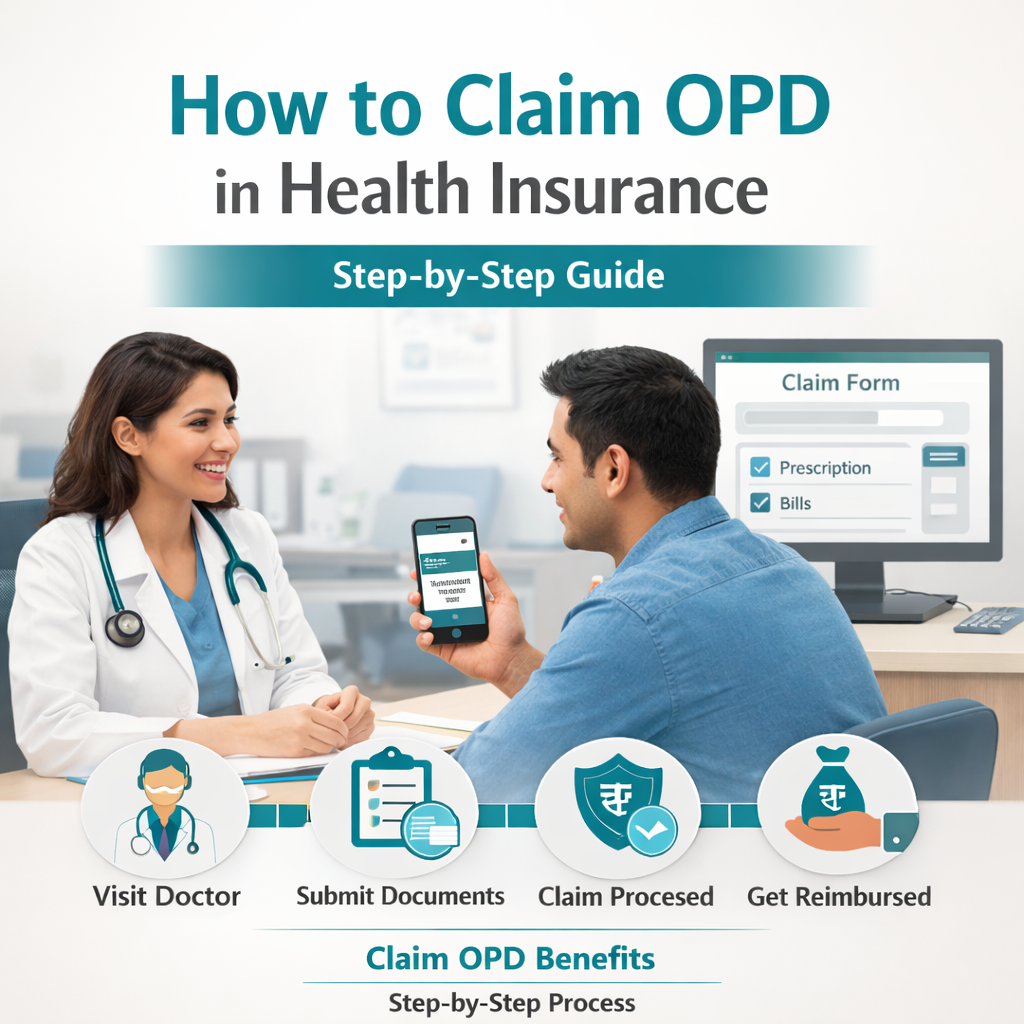

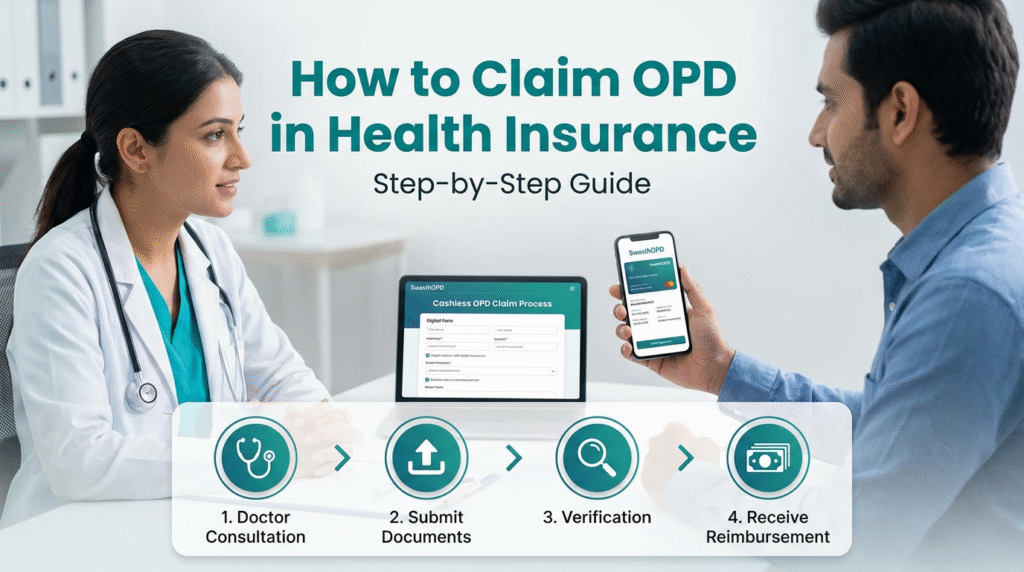

Knowing you have coverage is one thing; knowing how to use it is another. The process for claiming OPD benefits is generally straightforward, but it can vary slightly between insurers. Here is a step-by-step guide on how to claim OPD in health insurance.

If you want a seamless experience, make sure to familiarize yourself with each step on how to claim OPD in health insurance—from visiting a network provider to submitting the final claim documents. For many policyholders, a successful claim starts with good record-keeping and awareness of their plan’s rules for how to claim OPD in health insurance.

Step 1: Visit a Network Provider

Most medical insurance with OPD cover operates on a cashless or reimbursement basis. For a cashless claim, you must visit a clinic, hospital, or diagnostic center that is part of your insurer’s network. Check your insurer’s list of network providers before booking an appointment if you want to avoid any delays when you claim OPD in health insurance.

Step 2: Provide Your Policy Details

At the time of your appointment or test, present your health insurance card or policy number. The healthcare provider will verify your coverage details with the insurer.

Step 3: Avail Cashless Treatment (If Applicable)

If the provider and your policy support cashless claims, the insurer will settle the bill directly with the facility. You may only need to pay for any non-covered expenses or co-payments as per your policy terms.

Step 4: Collect All Documents for Reimbursement

If you pay for the services out-of-pocket or visit a non-network provider, you will need to file a reimbursement claim. Understanding how to claim OPD in health insurance means keeping the following documents ready:

- The original doctor’s prescription

- Original bills and receipts from the clinic, pharmacy, and diagnostic center

- All test and investigation reports

- A duly filled and signed claim form

Step 5: Submit Your Claim

Submit the claim form along with all the supporting documents to your insurer within the specified timeframe, which is typically 7 to 15 days from the date of treatment. You can usually do this online through the insurer’s portal or mobile app. Timeliness and accuracy are key when learning how to claim OPD in health insurance successfully.

Step 6: Claim Processing

The insurer will review your documents and process the claim. Once approved, the eligible amount will be transferred to your registered bank account.

Best OPD Health Insurance Plans for 2025

Choosing the right plan can be challenging, as benefits and premiums vary widely. The best OPD health insurance for you will depend on your individual needs, family size, and budget. No matter what policy you select, knowing how to claim OPD in health insurance will ensure you maximize the benefits.

Here are a few factors to consider when comparing plans for 2025 to make the process of how to claim OPD in health insurance even smoother:

- Coverage Limit: Plans offer different annual limits for OPD expenses. Some may have a sub-limit for specific services like dental care or consultations.

- Network of Providers: A wide network of hospitals and clinics ensures you have easy access to cashless services.

- Exclusions: Pay close attention to what is not covered. Common exclusions include cosmetic treatments, dietary supplements, and expenses for non-prescribed drugs.

- Premium: Compare the premiums against the benefits offered. A slightly higher premium might be worthwhile if it provides extensive OPD coverage.

- Claim Process: Look for insurers known for a smooth and quick claim settlement process—especially when you are researching how to claim OPD in health insurance.

For independent reviews and detailed comparisons of various health insurance plans, you can consult authoritative sources like the official site of the Insurance Regulatory and Development Authority of India (IRDAI).

Conclusion: Why Choose OPD Health Insurance?

OPD health insurance is a practical tool for managing your healthcare budget effectively. It covers the everyday medical expenses that can strain your finances over the year, promoting preventive care and timely medical intervention. By taking care of smaller bills, it allows you to save your primary health cover for more significant medical emergencies.

Remember, the key to fully utilizing your benefits is understanding how to claim OPD in health insurance and following the process carefully every time you make a claim. Should you need more guidance on how to claim OPD in health insurance or selecting the most suitable plan, don’t hesitate to visit our resource pages or get in touch with our support team. To learn more about our comprehensive health insurance plans with OPD benefits, explore the options available on our website today—your journey toward easy healthcare reimbursement begins with knowing how to claim OPD in health insurance.