Pharmacy Expenses Insurance: A Complete 2025 Guide for Affordable Healthcare

Rising medical costs are a significant concern for families across India. Beyond major hospital stays, the day-to-day expenses for medicines, doctor visits, and lab tests can strain household budgets. These out-of-pocket costs, especially for those with chronic conditions or elderly family members, add up quickly. Fortunately, modern healthcare solutions are evolving to address this challenge. One effective tool is pharmacy expenses insurance, designed to reduce the financial burden of medicine bills.

However, a new wave of accessible alternatives is making comprehensive care even more affordable. Platforms like SwasthOPD offer a streamlined approach, combining outpatient benefits with substantial pharmacy savings, ensuring your family gets the care it needs without financial stress. This guide will walk you through how these options work and help you make an informed choice for a healthier, more secure future.

What Is Pharmacy Expenses Insurance?

In simple terms, pharmacy expenses insurance is a type of health coverage that specifically helps pay for your prescribed medicines. Unlike standard health insurance that primarily covers hospitalization, this policy focuses on outpatient drug costs. It is designed to lower your out-of-pocket spending on everything from medicines for a sudden fever to long-term prescriptions for chronic conditions like diabetes or high blood pressure.

This coverage is especially valuable for managing the costs of ongoing treatments and emergency prescriptions. With a good pharmacy expenses insurance plan, you can significantly reduce your monthly medicine bills, making healthcare more manageable and predictable.

Key Benefits of Pharmacy Expenses Insurance

Opting for a plan that covers pharmacy expenses offers several practical advantages for managing your health budget.

- Reduces Monthly Medicine Bills: For many families, the cost of prescribed drugs is a recurring monthly expense. This coverage directly subsidizes that cost, freeing up your budget for other essential needs.

- Essential for Chronic Patients: Individuals managing long-term conditions like diabetes, heart disease, or arthritis often require daily medication. Pharmacy coverage makes this continuous care more affordable.

- Provides OPD Medicine Coverage: It bridges a critical gap left by many traditional health policies by covering medicines prescribed during outpatient (OPD) consultations.

- Supports Families with Long-Term Needs: Families with elderly parents or members requiring consistent medication find this coverage indispensable for maintaining health without financial strain.

- Works with SwasthOPD Pharmacy Discounts: When combined with a SwasthOPD plan, you not only get coverage benefits but also access direct discounts at partner pharmacies, maximizing your savings on every purchase.

Understanding OPD Insurance

OPD insurance is a form of health coverage that pays for outpatient expenses, which are medical costs incurred without being admitted to a hospital. This includes common healthcare needs like doctor consultation fees, diagnostic tests, and prescribed medicines. Since a majority of healthcare interactions happen on an outpatient basis, having OPD coverage is crucial for comprehensive financial protection. SwasthOPD enhances this by offering plans that provide access to doctor consultations and lab tests at reduced costs. You can explore our Plans to find the right fit or Contact Us for more details.

Features of an OPD Policy

An OPD policy is structured to cover day-to-day medical needs. Its features often include a defined limit for doctor fees, diagnostics, and pharmacy bills. For example, a family that spends ₹3,000 monthly on medicines for a diabetic parent could see their costs significantly reduced with an effective OPD plan. SwasthOPD’s Life Plan, for instance, provides pharmacy discounts and tele-consultations that directly lower these recurring expenses. These policies are designed to work within the healthcare framework supported by global health bodies, which emphasize the importance of accessible primary care. For further information on how OPD and outpatient coverage improve public health access, refer to trusted resources from the World Health Organization.

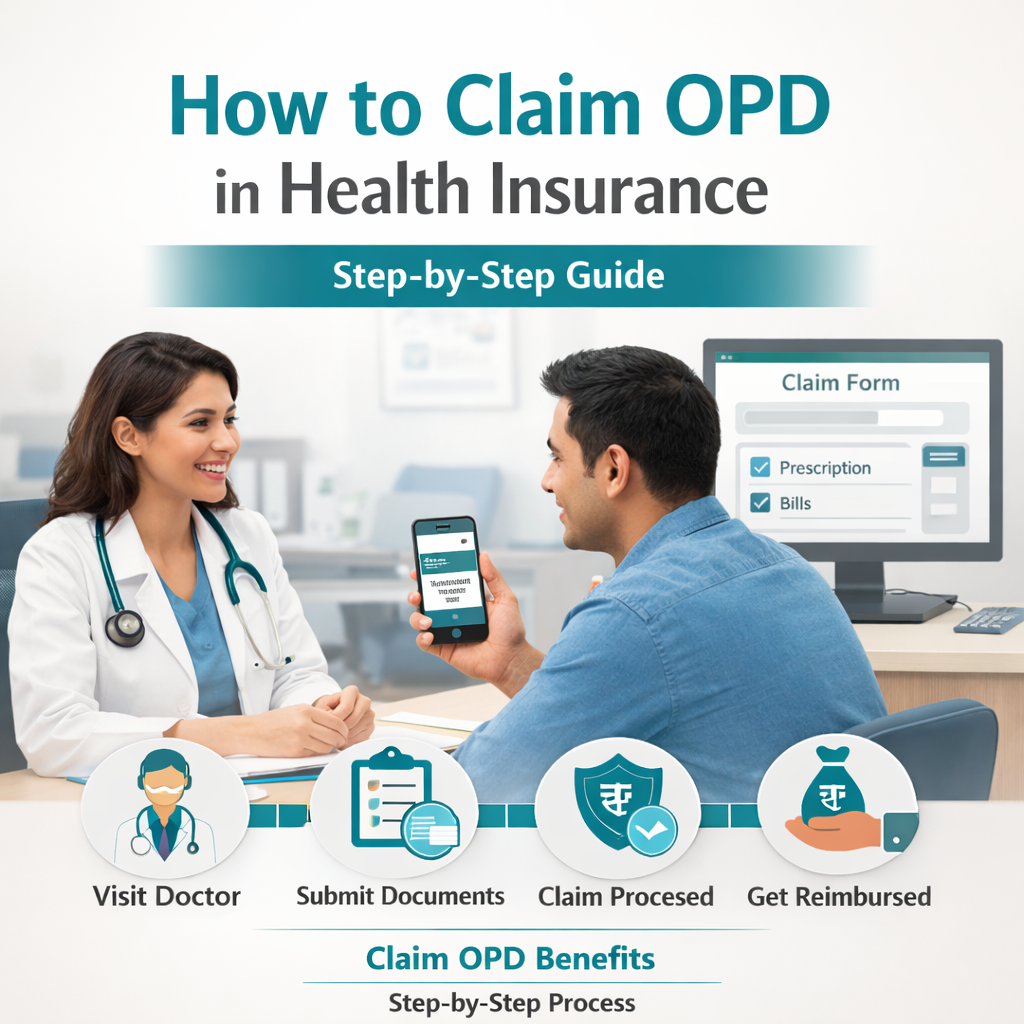

Making an OPD Claim

Filing an OPD claim is the process of getting reimbursed for your outpatient medical expenses. With traditional insurers, this often involves submitting bills and prescriptions and waiting for approval. However, modern platforms are simplifying this. SwasthOPD offers a cashless journey for many services. You can use the app to book consultations or get discounts at pharmacies directly, eliminating the need for complex paperwork. For any services requiring reimbursement, the process typically involves uploading digital copies of your bills and prescriptions through the member portal, as outlined in our Terms & Policies.

How Do Your Options Compare?

| Feature | Regular Medical Insurance | Pharmacy Expenses Insurance | SwasthOPD OPD Plan |

|---|---|---|---|

| Primary Focus | Hospitalization Expenses | Prescription Medicine Costs | Overall Outpatient Care |

| Doctor Visits (OPD) | Generally Not Covered | Generally Not Covered | Covered (Unlimited Tele-consultations) |

| Pharmacy Bills | Not Covered (Unless hospitalized) | Primary Coverage | Covered via Discounts (Up to 20% off) |

| Diagnostic Tests | Not Covered (Unless hospitalized) | Not Covered | Covered via Discounts |

| Ease of Use | Complex Claim Process | Reimbursement-Based | Cashless Journeys & Instant Discounts |

| Best For | Major Surgeries & Emergencies | Chronic Medication Needs | Everyday Health & Wellness Management |

When Should You Buy Pharmacy Expenses Insurance?

Consider a plan that covers pharmacy expenses if you fall into one of these categories:

- You Have a Chronic Illness: Managing conditions like diabetes, hypertension, or asthma requires continuous medication.

- You Care for Elderly Parents: Seniors often need multiple prescriptions, and coverage can make their care more affordable.

- Your Family Has Frequent Doctor Visits: If you have young children or frequently fall ill, medicine costs can add up.

- You Have Lifestyle-Related Medicine Needs: Many people rely on supplements or medicines for lifestyle conditions, which can be covered

How SwasthOPD Reduces Pharmacy & OPD Costs

SwasthOPD offers a smart, integrated solution that goes beyond traditional pharmacy expenses insurance. Our plans are designed to provide immediate and tangible savings on your everyday healthcare needs.

- Up to 20% Off on Prescribed Pharmacy: Get instant discounts on medicines at a wide network of partner pharmacies.

- Unlimited Tele-consultation: Speak with qualified doctors anytime, anywhere, without worrying about consultation fees.

- Diagnostic & Radiology Discounts: Save money on essential lab tests and scans.

- OPD Visits: Access our network of clinics for physical consultations at a lower cost.

- Cashless Journeys: Use the SwasthOPD app for a seamless, paper-free experience from consultation to medicine purchase.

Ready to take control? Explore our plans, read our terms, or contact us to get started.

Conclusion

Managing healthcare costs effectively requires looking beyond just hospitalization coverage. With rising medicine prices, having a plan for your pharmacy bills is more important than ever. While pharmacy expenses insurance is a good step, integrated solutions like SwasthOPD offer a smarter, more comprehensive alternative. By combining OPD benefits with direct pharmacy savings, SwasthOPD provides an affordable and convenient way to manage your family’s complete healthcare needs.

Visit SwasthOPD.com to explore affordable OPD health plans for your family.