When you think about health insurance, the first thing that often comes to mind is hospitalization. But what about the medical expenses that don’t require an overnight stay? Regular doctor visits, diagnostic tests, and pharmacy bills can add up quickly. This is where Out-Patient Department (OPD) cover comes in.

This guide will explain what Is OPD cover In Health Insurance. how it works, and why it’s becoming an essential part of modern healthcare plans. Understanding What is OPD Cover in Health Insurance benefit And How You manage your everyday medical costs more effectively.

What is OPD Cover in Health Insurance?

OPD cover in health insurance is a provision that pays for medical expenses incurred without being admitted to a hospital. These are commonly known as out-patient costs. This can include everything from a routine check-up for a fever to diagnostic tests and prescribed medicines.

While traditional health insurance policies primarily focus on in-patient hospitalization (IPD), policies with OPD benefits are designed to cover the day-to-day medical costs that make up a large portion of a family’s health spending. You can learn more about the key differences between OPD and IPD here.

OPD coverage typically includes:

- Doctor consultations (general physicians and specialists)

- Diagnostic tests like blood work, X-rays, and MRIs

- Pharmacy bills for prescribed medications

- Minor surgical procedures

- Dental treatments and eye care (depending on the plan)

Which Health Insurance is Best for OPD?

Finding the best health insurance for OPD depends on your specific needs, such as how often you visit a doctor or if you have ongoing treatments. The ideal plan offers a balance of comprehensive coverage, a wide network of healthcare providers, and affordability.

Standalone health insurance policies from major insurers may offer OPD cover as an add-on, but these can sometimes be limited. A dedicated wellness plan often provides more extensive and flexible benefits. For example, custom healthcare plans allow you to choose the services you need most, ensuring you don’t pay for benefits you won’t use.

At Swasth, we offer personalized health plans for individuals and corporates that are designed to make out-patient care affordable and accessible.

How Does Cashless OPD Work?

Cashless OPD is a convenient feature that allows you to receive out-patient services without paying out of pocket. Instead of paying the clinic or diagnostic center and then filing for reimbursement, the insurer settles the bill directly with the network provider.

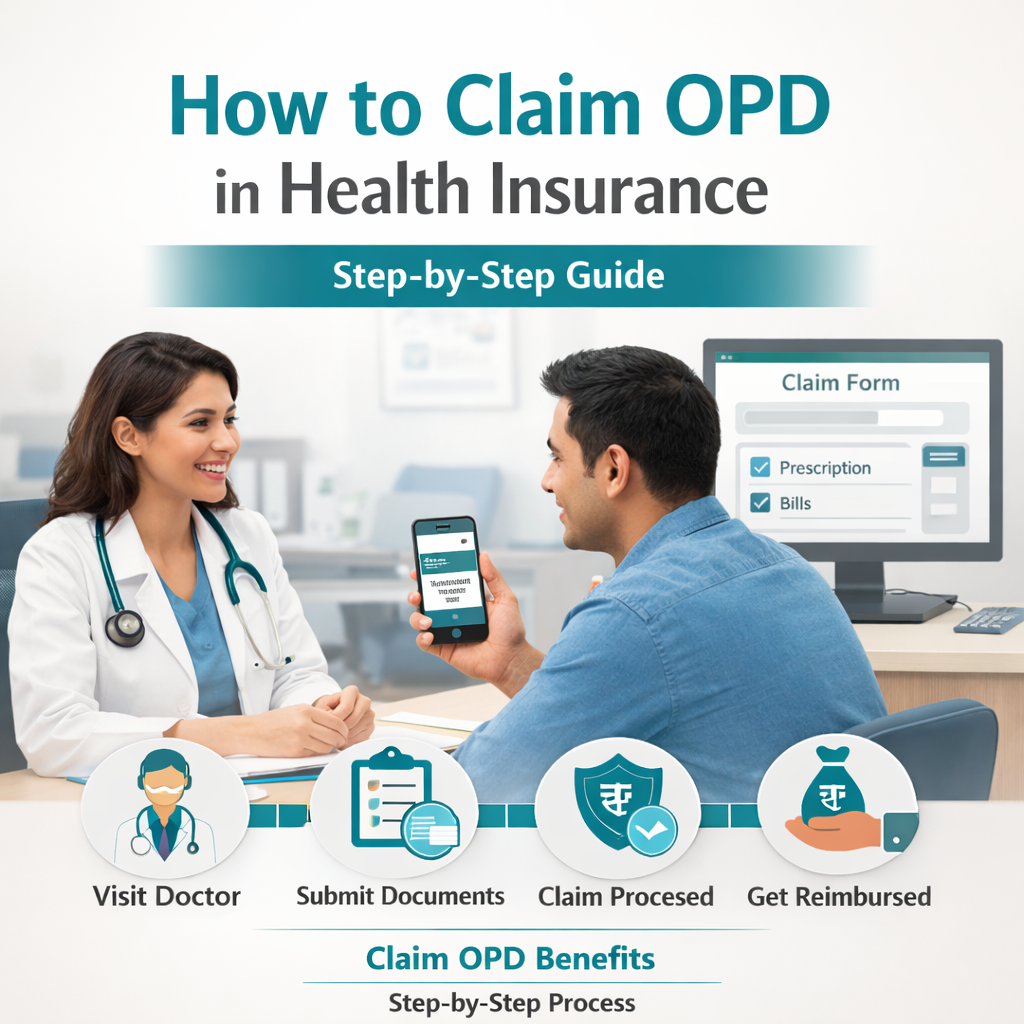

Here’s a simple breakdown of the process:

- Find a Network Provider: Locate a doctor, clinic, or diagnostic center within your insurer’s network.

- Present Your Details: Show your health card or policy details at the reception.

- Receive Treatment: Get your consultation, test, or treatment as needed.

- Direct Settlement: The provider sends the bill directly to the insurer for payment.

This system simplifies the healthcare process, making it faster and more convenient. Cashless OPD plans are considered the future of healthcare because they eliminate the financial burden and paperwork associated with reimbursement claims.

Can I Buy OPD Only Insurance?

Yes, it is possible to buy plans that focus primarily on OPD benefits. These are often structured as wellness or preventative care plans rather than traditional health insurance policies. These plans are an excellent choice for individuals who want coverage for regular health expenses but don’t need comprehensive hospitalization cover, or for those who want to supplement their existing IPD policy.

SwasthOPD specializes in providing these types of plans. Our packages are designed to cover your out-patient needs, offering services like unlimited tele-doctor consultations, in-person GP visits, and discounts on diagnostics and pharmacy purchases. You can explore our different plans to find one that fits your requirements.

How SwasthOPD Can Help

Navigating the world of health insurance can be complex, but you don’t have to do it alone. At SwasthOPD, our experts are here to help you understand your options and choose a plan that truly meets your needs. With over 12 years of experience and a network of over 600 doctors, we are your trusted partner in health.

Our health insurance with OPD cover guide provides even more detailed information. Whether you need a plan for yourself, your family, or your company, our team can design a personalized and affordable solution.