Unlock Affordable Healthcare: What is OPD Cover in Health Insurance?

When you think about What is OPD Cover in Health Insurance, your mind likely goes straight to major medical events—surgeries, accidents, and lengthy hospital stays. While this kind of coverage is essential, what about the more frequent, everyday healthcare expenses? Regular doctor visits, diagnostic tests, and pharmacy bills can add up quickly. This is where OPD cover in health insurance becomes a game-changer for managing your health and your budget.

This guide will explain exactly what OPD cover is, why it’s important, and how it can help you access affordable healthcare for your routine medical needs. We’ll cover the benefits, what’s typically included, and how you can find the right plan for you and your family. Understanding OPD coverage is the first step toward a more holistic and stress-free healthcare journey.

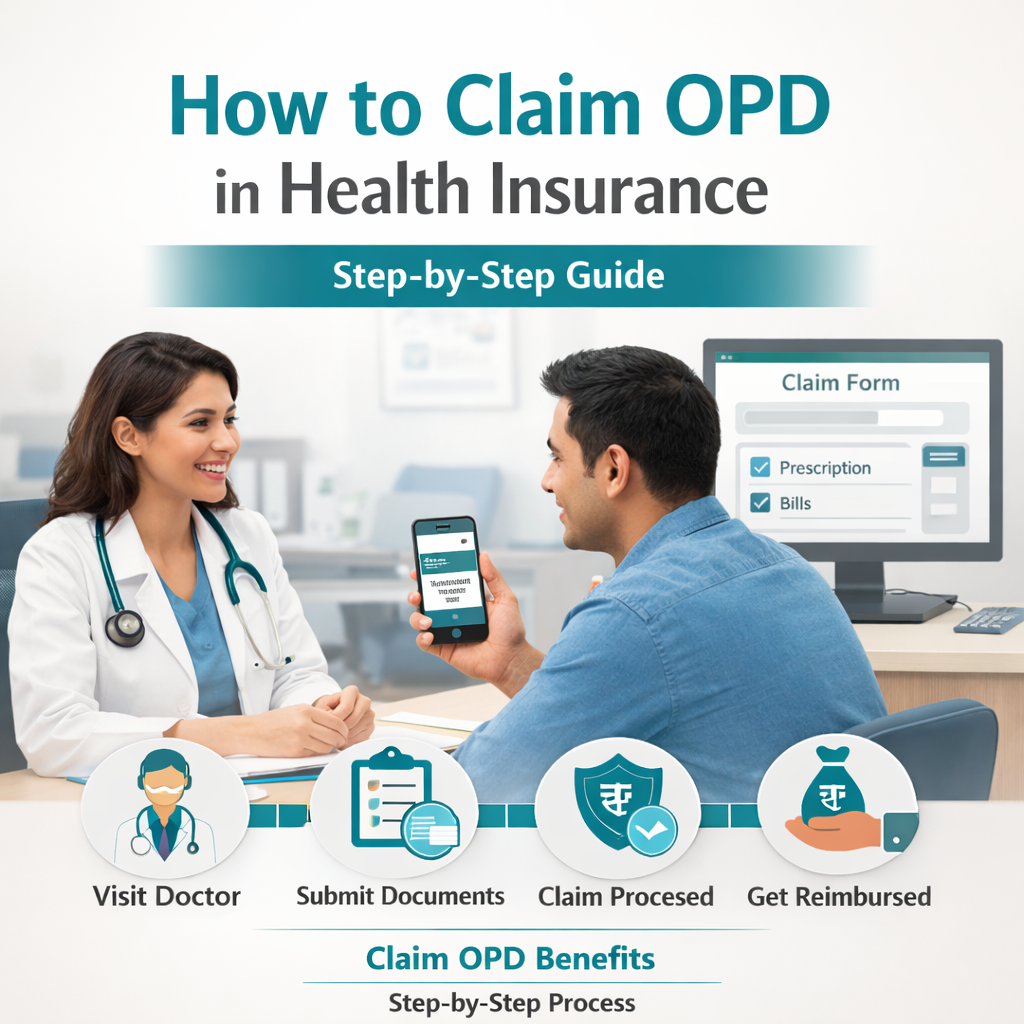

What is OPD Cover in Health Insurance?

OPD stands for Out-Patient Department. Unlike in-patient hospitalization, which requires you to be admitted to a hospital for 24 hours or more, OPD treatments are medical services you receive without being admitted. This includes doctor consultations, routine check-ups, diagnostic tests, and pharmacy expenses.

OPD cover is an add-on or a standalone feature in health insurance plans that pays for these out-patient expenses. Traditionally, most health insurance policies in India have focused only on hospitalization. However, with rising costs for consultations and diagnostics, the demand for OPD coverage has grown significantly. It provides a financial cushion for your day-to-day medical needs, ensuring you don’t have to pay out-of-pocket every time you visit a doctor or get a lab test.

Is OPD Covered in Standard Health Insurance?

Typically, standard health insurance plans do not cover OPD expenses. Their primary focus is on in-patient hospitalization (IPD) costs, which include room rent, surgery fees, and other related charges. This means that if you have a basic health policy, you are likely paying for all your doctor visits and prescribed medications yourself.

However, the insurance landscape is evolving. Many providers now offer specific OPD Health Plans or riders that can be added to your existing policy. These plans are designed to make routine healthcare more accessible and affordable. It’s important to check the terms of your policy to see if OPD expenses are included or if you need to purchase a separate plan for this coverage.

What is Typically Included in OPD Coverage?

The scope of OPD coverage can vary between different insurance providers and plans. However, most comprehensive OPD plans will cover the following expenses:

Key Inclusions

- Doctor Consultations: Fees for visiting a general physician or a specialist for any health concern. This can include both in-person and tele-consultations.

- Diagnostic Tests: Costs for lab tests, X-rays, MRIs, CT scans, and other diagnostic procedures prescribed by a doctor.

- Pharmacy Bills: Expenses for medicines prescribed by a medical practitioner.

- Dental Treatments: Some plans offer coverage for routine dental procedures like fillings, root canals, and extractions.

- Vision Care: This may include costs for eye check-ups and the price of spectacles or contact lenses.

- Minor Procedures: Small surgical procedures that do not require hospitalization can also be covered.

Which Health Insurance is Best for OPD?

Finding the best health insurance for OPD depends on your individual needs, budget, and how frequently you use out-patient services. Some people may need frequent consultations for a chronic condition, while others might only need coverage for occasional check-ups.

When comparing plans, consider the following factors:

- Coverage Limit: Check the maximum amount you can claim for OPD expenses in a policy year.

- Network of Providers: Look for a plan with a wide network of partner clinics, hospitals, and diagnostic centers for cashless services.

- Sub-limits: Be aware of any sub-limits on specific services, like consultation fees or pharmacy bills.

- Waiting Periods: Some policies may have a waiting period before you can start claiming OPD benefits.

- Premium Cost: Compare the premium against the benefits offered to ensure you are getting good value.

For many working professionals and families, a platform like SwasthOPD offers a simplified and budget-friendly approach. Instead of navigating complex insurance policies, you get access to a Tech-based healthtech infrastructure that provides a seamless digital experience for all your OPD needs.

Can I Buy OPD-Only Insurance?

Yes, you can buy OPD-only insurance plans. These plans are specifically designed to cover only out-patient expenses and do not include hospitalization benefits. This can be a great option for younger individuals who are generally healthy but want coverage for routine medical care. It is also beneficial for those who already have a corporate or personal health insurance plan that covers hospitalization but lacks OPD benefits.

Standalone OPD plans offer a cost-effective way to manage your healthcare expenses without paying a high premium for comprehensive coverage you may not need. They often come with features like unlimited tele-consultation and discounts at network pharmacies and diagnostic centers, making them a practical choice for everyday health management.

How Swasth OPD Helps You Access These Plans

Navigating the world of health insurance can be confusing, but SwasthOPD makes it simple. As a leading health and wellness broker, we are dedicated to providing affordable and accessible healthcare solutions for individuals, families, and corporate clients. We bridge the gap by offering personalized health plans that focus on your complete well-being.

Here’s how our experts can help:

- Tailored Plans: We offer a variety of plans, like our Basic Plan and Life Plan, designed to meet different needs and budgets. Our team helps you choose the right one for you.

- Cashless Access: With a network of over 600+ doctors and 220+ hospitals, you can enjoy cashless OPD consultations and services. No more saving receipts and waiting for reimbursements.

- Comprehensive Wellness: Our services go beyond doctor visits. We provide pharmacy discounts, diagnostic discounts, and even access to gym membership discounts to support your holistic wellness.

- Digital Convenience: Our user-friendly digital health platform and app allow you to manage your health on the go. Book appointments, access digital health records, and connect with doctors with just a few clicks.

As trusted partners for over 110+ corporates and 28,000+ customers, we are committed to delivering a transparent and hassle-free healthcare experience. Our goal is to ensure your well-being through expert guidance and simplified access to quality care.

Find Your Ideal Healthcare Solution Today

Understanding what Is OPD cover is in health insurance is the first step toward taking full control of your healthcare spending. By covering day-to-day medical expenses, these plans provide financial relief and encourage proactive health management. Whether you choose a standalone OPD plan or a comprehensive policy, having this coverage ensures you are prepared for both minor ailments and routine check-ups.

If you’re looking for a simple, affordable, and effective way to manage your out-patient health needs, explore the OPD Health Plans offered by SwasthOPD. Our team is ready to help you find the perfect solution for a healthier, happier you.

Which health insurance is best for OPD?

The best health insurance for OPD depends on your individual needs. If you already have hospitalization cover, a standalone OPD plan from a provider like Swasth OPD might be ideal. If you are looking for an all-in-one solution, a comprehensive plan that includes both IPD and OPD benefits would be the best choice. Look for plans that offer a wide network, cashless facilities, and high claim settlement ratios.

Is OPD covered in health insurance?

It depends on the policy. Most basic health insurance plans do not cover OPD expenses by default. However, you can often purchase it as an add-on rider, or you can opt for a comprehensive plan that includes OPD benefits. Specialized health platforms also offer dedicated OPD-only plans.

Can I buy OPD only insurance?

Yes, you can buy OPD-only insurance. Providers like SwasthOPD specialize in offering health plans that focus specifically on out-patient expenses. These plans are a great way to manage costs for doctor consultations, diagnostic tests, and pharmacy bills without needing a full hospitalization policy.